- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Top 10 Chartbook 12232023

Location Strategy Top 10 Chartbook 12232023

Smart, Fast, Affordable, Local

We wanted to say thanks to our clients and readers in this last newsletter of the year, and wish you all a Happy Holiday Season. Because of you, we had an incredibly successful year, accomplishing the following:

61 market studies or research projects in locations across the state of Texas

Grew from 2 to 6 employees

Signed a lease on new office space

Opened our land brokerage company, PropertIQ LLC

We know speed is important on your projects - starting January 1, 2024 every market study or research product that we produce will have our 30-day guarantee. If we don’t complete your study in 30 days, we will refund 100% of your money.

Enjoy the holidays - we look forward to serving you next year. Come by and see us at the new office.

Our new address: 701 North Post Oak Ste 315, Houston, TX 77024

LOCATION STRATEGY CHARTBOOK

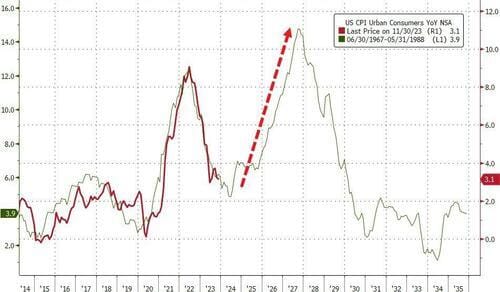

Inflation is Coming Back

Mortgage rates are now around 6.6% without any action by the Fed. We’ve spent the last several weeks explaining why we believe the Fed will cut rates. We still believe this thesis, and we think it will do so at higher than expected levels of inflation. Here’s why we think high inflation will persist (explanation courtesy of Simon White, Bloomberg macro strategist). The first chart shows current inflation vs the 1970s, and in the second it shows how 1970s it came in three phases:

Both charts show how the Fed tried to end the fight against inflation too early. There are a number of metrics forecasting the return of inflation:

Supply chain pressures are rising again

Wage growth is still elevated and signs show it’s likely to start growing again next year

Consumer Inflation Expectations Are Rising

Profits and Profit margins - profit margins are large and fiscal deficit next year is likely to inflate them further

China is borrowing money to stimulate its economy, which will have inflationary effects worldwide

Worldwide Food Prices are increasing - these lead US CPI by 6 months or so

Finally the inflation leading indicator is going up

These are eight significant indicators suggesting inflation lies ahead. Again, for the reasons we’ve outlined over the last several weeks, we believe the Fed will persist in rate cuts anyway. But be prepared for it to be slow and also for the need to potentially revisit many of the same strategies we used in 2020-2022 to deal with it.

In total, monetary and fiscal policies will be a drag on economic growth in 2024.

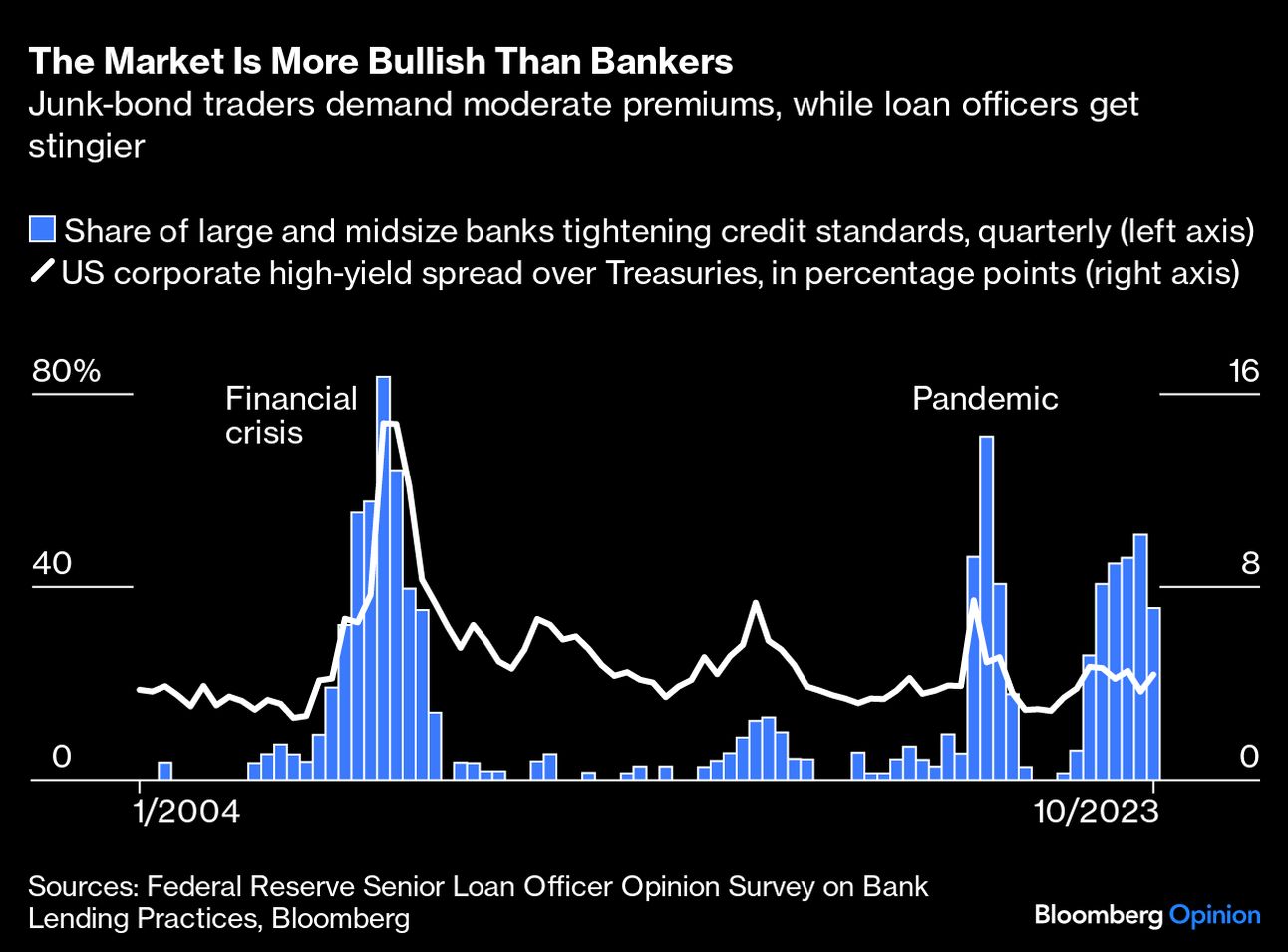

"Over time, tighter standards as measured by the Federal Reserve’s quarterly survey of senior lending officers have strongly correlated with rising credit spreads. That hasn’t happened in 2023."

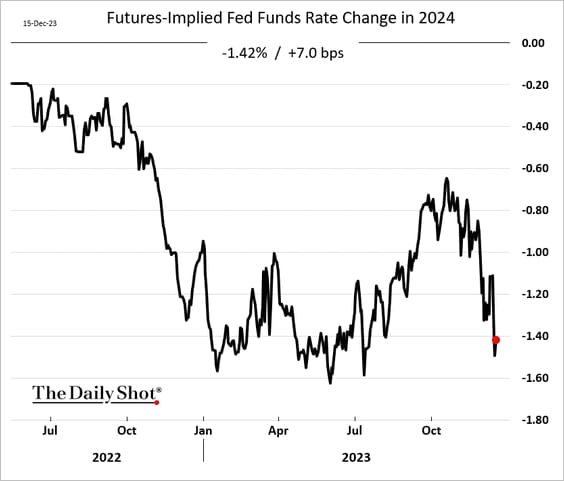

Nonetheless, the market is still pricing in some 140 bps of rate cuts next year.

The Atlanta Fed’s wage growth tracker is holding above 5%.

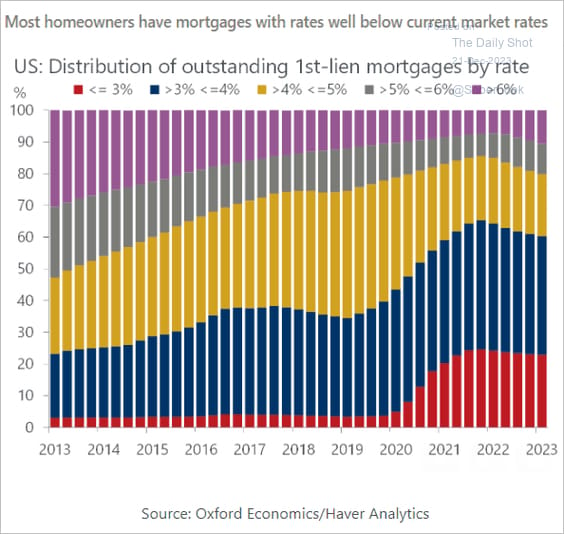

The drop in mortgage rates means that now about 10% of mortgages are above current rates - probably not enough of a change to start seeing increased inventory on the used home market.

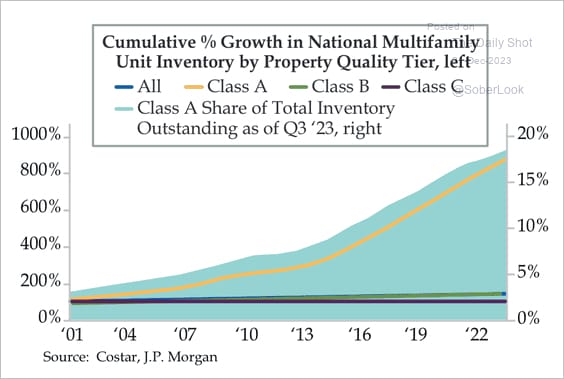

The supply of luxury apartments has increased substantially in recent years. An overhang?

Total starts were up 9.3% in November compared to November 2022. And starts year-to-date are down 9.9% compared to last year.

Starts were down year-over-year for 16 of the last 19 months (May, July and now November 2023 were the exceptions), and total starts will be down this year - although the year-over-year comparisons are easier in December.

Builders are now completing more single-family homes than they are starting on a 12-month basis. However, single family starts have turned up on a 12-month basis.

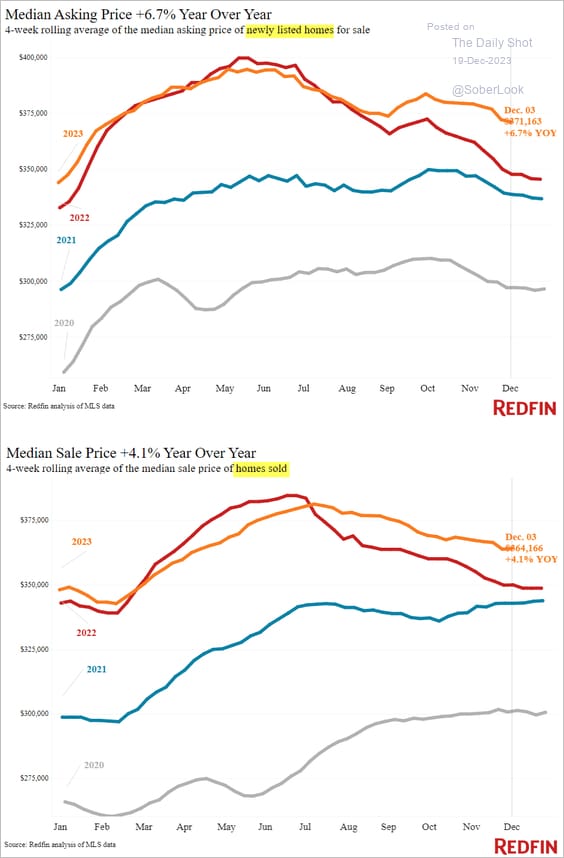

Asking prices for newly-listed homes are well above last year’s levels.

Over 41% of household income now goes into mortgage payments for recently purchased homes.

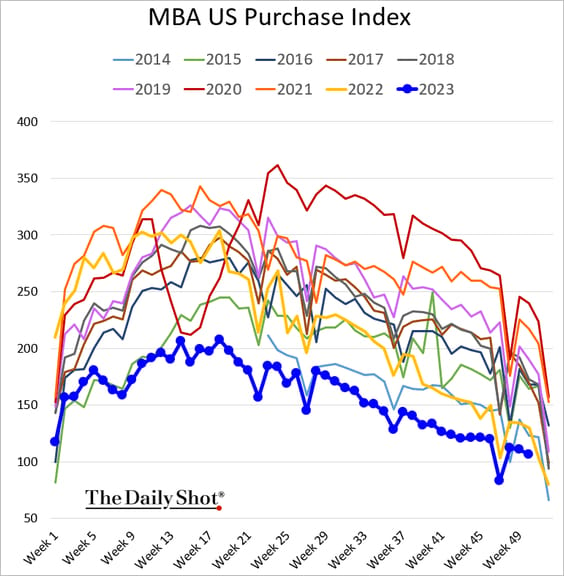

Mortgage applications have been a bit firmer in recent weeks.