- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Chartbook 11.23.24

Location Strategy Chartbook 11.23.24

Real Estate Market Insights

We’ll be taking a holiday for the Thanksgiving weekend so there will be no Chartbook next week. Happy Thanksgiving all!

The math is grim.

“I don’t think we have the fiscal room to cut taxes from where they are today,” Citadel’s Ken Griffin said, “and I think there’s a real question about where do we need to raise taxes to start to put our house in order.”

He said Trump in his first term made a bet that cutting taxes would contribute to productivity gains, but it’s hard to know whether that bet paid off, given the regulatory constraints on corporate America’s growth during President Joe Biden’s administration. Griffin thinks that made businesses less productive.

Other Trump policies pose risks to the economy, markets and the direction of interest rates as well. A crackdown on immigration, for example, could spur inflation, especially when immigrants populate jobs everywhere from restaurant kitchens to the C-suite in Silicon Valley.

The issue is quite circular. Higher inflation can lead to higher interest rates, and the US government’s borrowing costs are one of the biggest expenses in the national budget. Bloomberg asked Griffin whether the bond market would face problems as the national debt load swelled. He said the country clearly can’t sustain this deficit for the next 20 years.

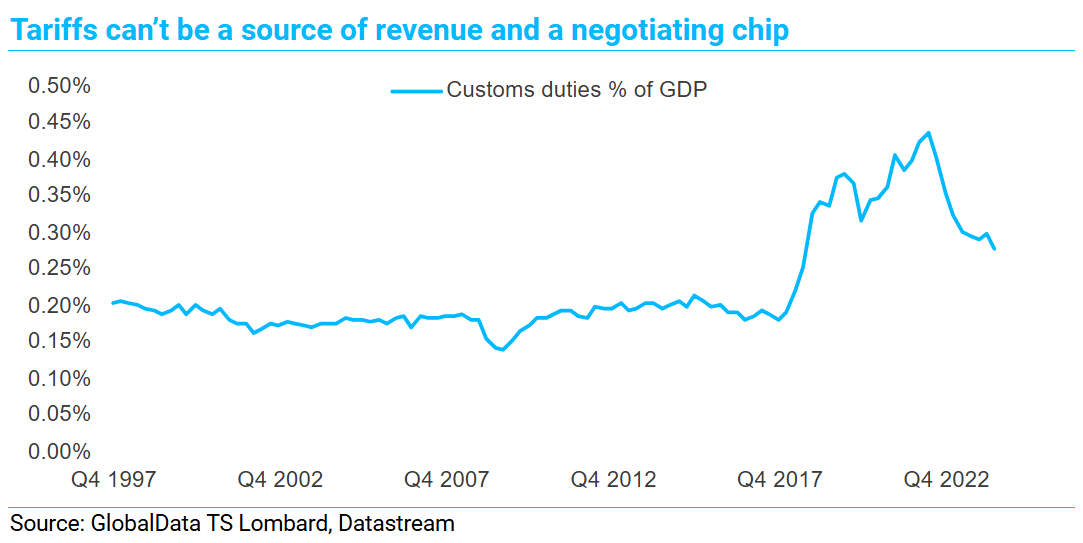

Much, if not most, of the focus on the incoming Trump administration’s international economic policy has been on tariffs on imported goods. But don’t dismiss the potential for more restrictive measures in finance: namely, capital controls.

So says Freya Beamish, chief economist at TS Lombard. The basic logic: Restrictions on foreign investment in dollars could help rebalance trade, because other countries would have nowhere to put their export earnings — unless they bought American goods.

Another problem is that tariffs tend to drive up the dollar, making trading partners’ exchange rates all the more competitive — as Scott Bessent, a hedge fund manager who advised Donald Trump’s campaign and has been a candidate for Treasury secretary, acknowledged earlier this month.

“Trump simply cannot have both tariffs and an escape from the strong dollar unless he considers the capital account and that would be a game changer,” Beamish says.

“Telling the rest of the world, that the Treasury does not want their funds might seem like shooting oneself in the foot. But it has to be considered as a tail risk,” Beamish says. “Capital controls seem likely at least to gain popularity as an idea, and even mere ideas can cause some volatility down the line.”

Bitcoin is on the cusp of hitting $95,000 as the digital-asset sector moves to cement its influence with Donald Trump by pushing for a new White House post dedicated to cryptocurrency policy.

Trump’s team is holding discussions about whether to create such a role for the first time and the industry is pitching for the position to have direct access to the president-elect, who is now one of crypto’s biggest cheerleaders.

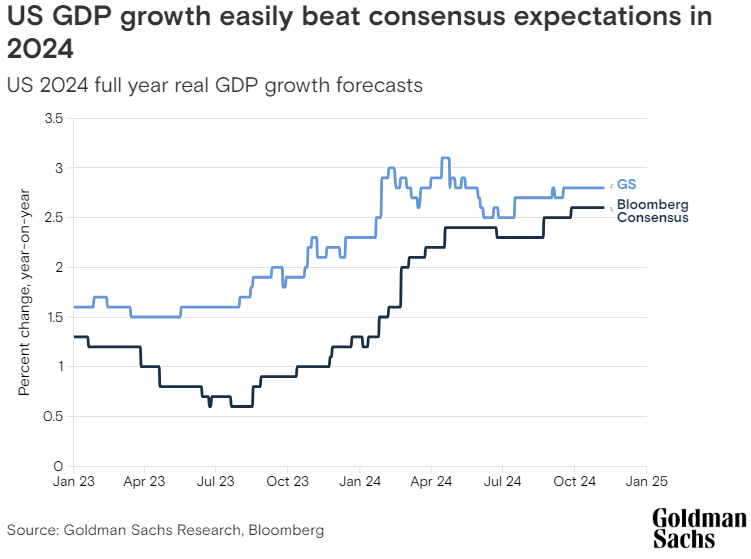

US GDP is expected to grow 2.5% on a full-year basis, compared with 1.9% for the consensus forecast of economists surveyed by Bloomberg.

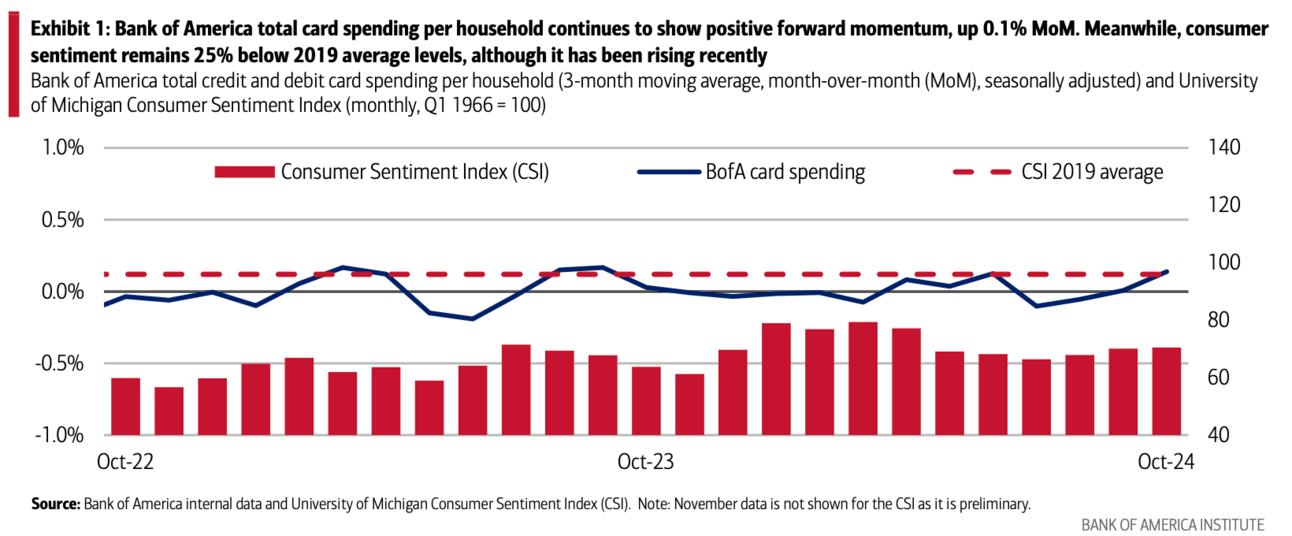

Consumers feel gloomy, yet continue to spend

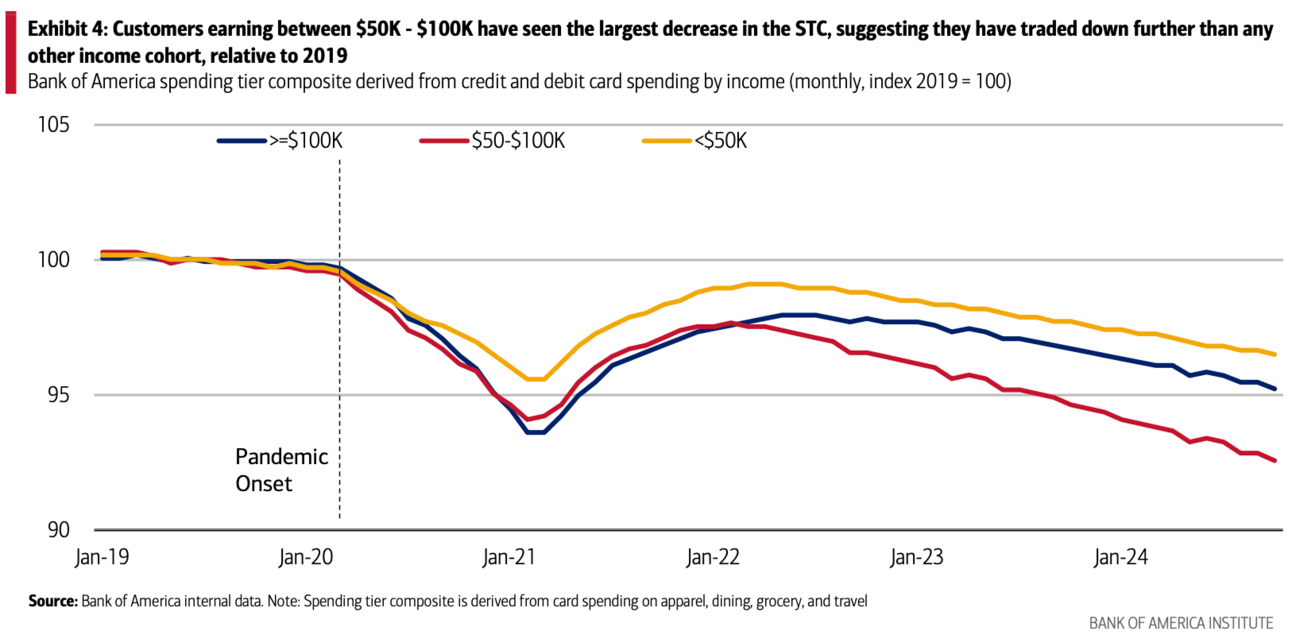

Looking across all income levels, we see that consumers of all incomes are moving toward value spending. However, Bank of America card data also suggests that people earning less than $50K have seen a comparatively smaller level of trade down, on average, through October 2024, relative to their 2019 level

The spending tier composite for customers with incomes over $100K also indicates a comparatively lower level of trade down on average through October. This is likely due, in part, to an economic truism: those with higher incomes likely have a bigger financial cushion as well as varied sources of income to absorb cost-of-living increases.

The global wellness economy has grown rapidly in the aftermath of the pandemic and reached a new peak of $6.3 trillion in 2023.

Wellness, clean air, clean water, housing built for ideal sleep conditions, lighting, mood, low VOC/ less toxic materials is seemingly missed by the largest new homebuilders & multi family developers and is an opportunity to explore.

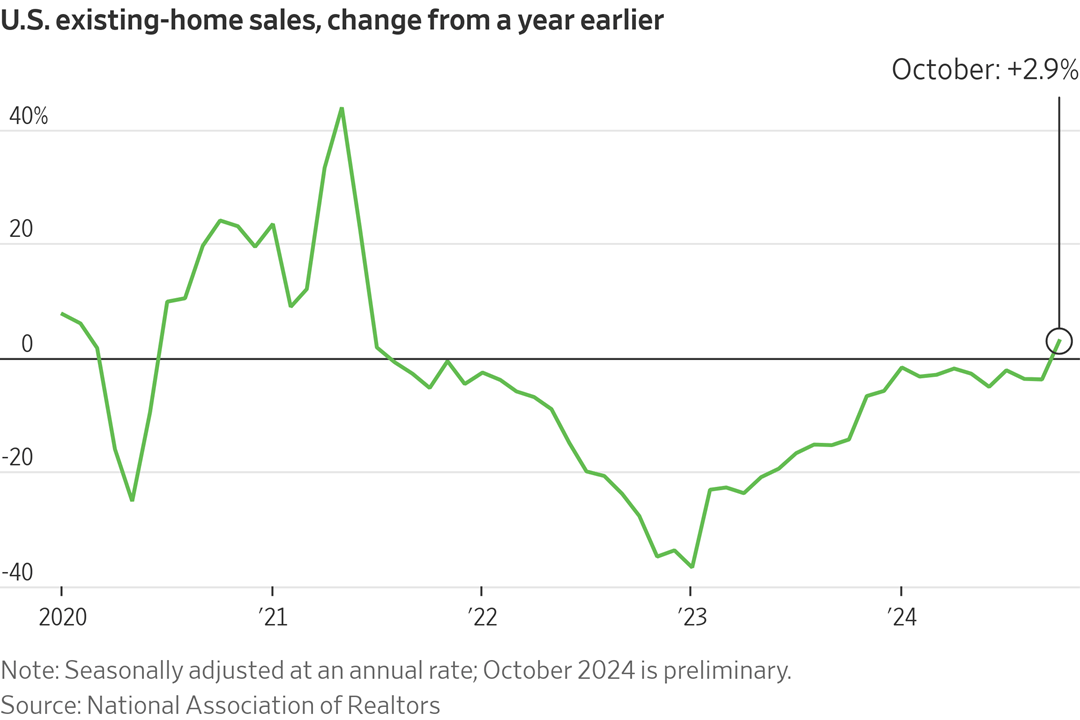

Sales of existing homes picked up in October, boosted by a short-lived decline in mortgage rates.

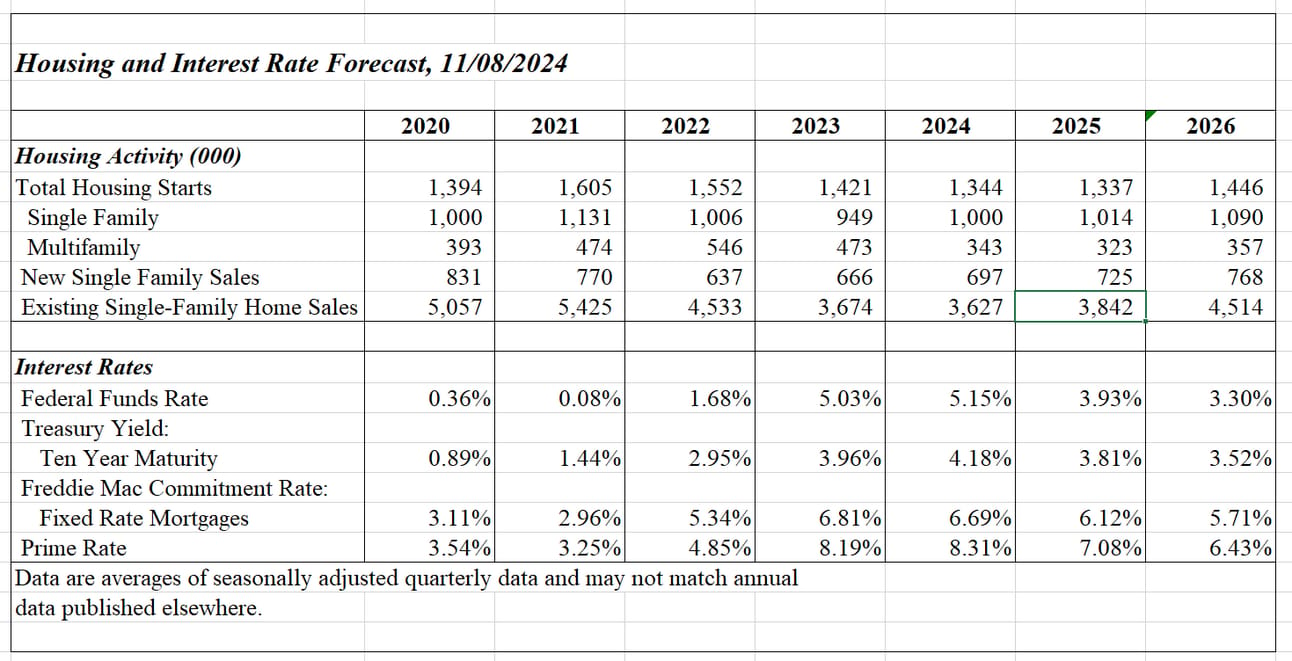

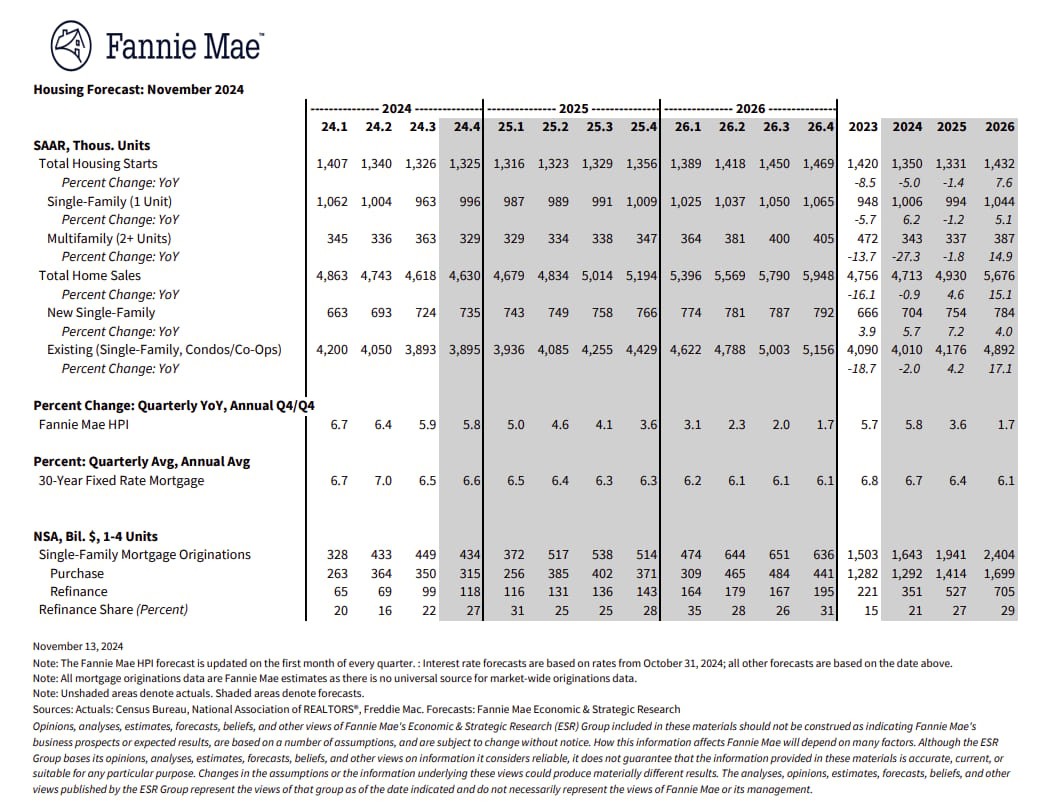

Total housing starts will be around 1.35 million in 2024, down from 1.42 million in 2023.

Existing home sales will be around 4.0 million in 2023, down from 4.1 million in 2023.

As of August, Case-Shiller house prices were up 4.2% year-over-year, but the year-over-year change will likely decrease a little further over the next few reports.

Here are two housing forecasts for 2025:

From NAHB