- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Chartbook 11.16.24

Location Strategy Chartbook 11.16.24

Real Estate Market Insights

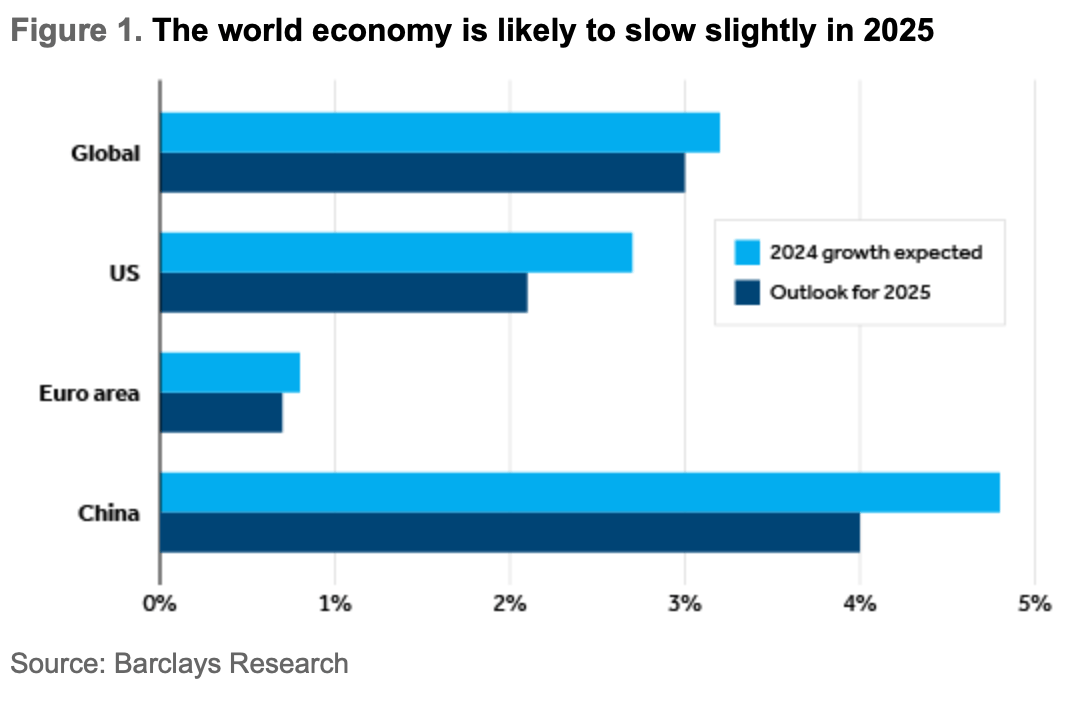

Tariffs and curtailed immigration will likely pull growth down slightly. We expect the world economy to grow 3% next year, a bit slower than this year, but still resilient.

That would be due partly to the US decelerating due to tariffs and immigration controls, but there will also be a fiscal boost to counter them from de-regulation and tax cuts also promised by Trump. Europe is likely to grow at trend, despite trade risks.

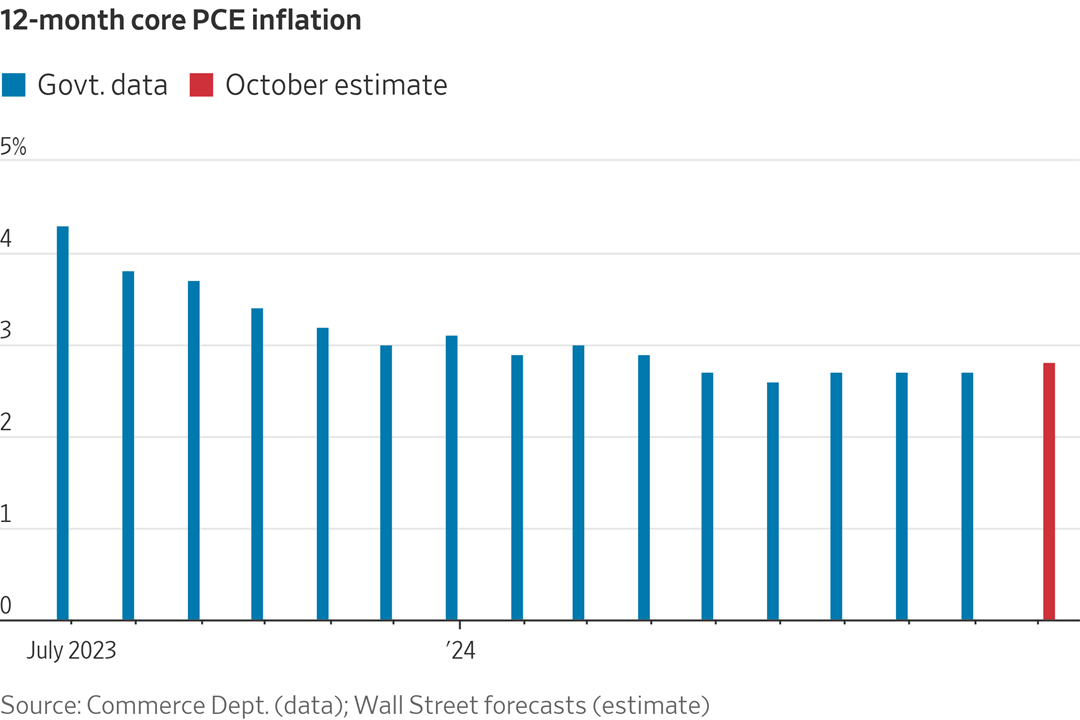

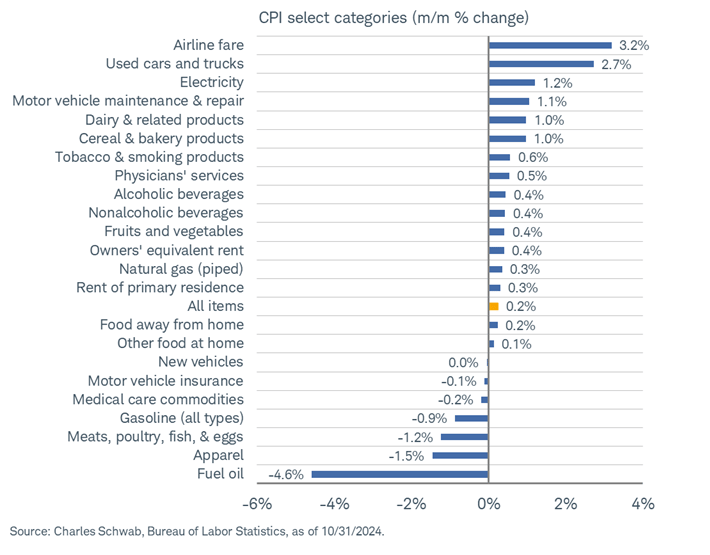

The Federal Reserve might not see much more inflation relief before it decides next month whether to keep cutting interest rates. Using this week's separately derived CPI and PPI data, economists are projecting that core PCE inflation rose back to 2.7% or 2.8% in October. The personal consumption expenditures price index is the Fed's preferred measure of inflation.

Federal Reserve Chair Jerome Powell said recent signs of economic health would allow the central bank to take its time in deciding how quickly to continue reducing interest rates, including by potentially slowing down the pace of cuts.

Boston Fed president Susan Collins said the central bank could eventually need to slow down the pace of rate cuts. She said it was too soon to say whether that should happen at the central bank’s meeting next month.

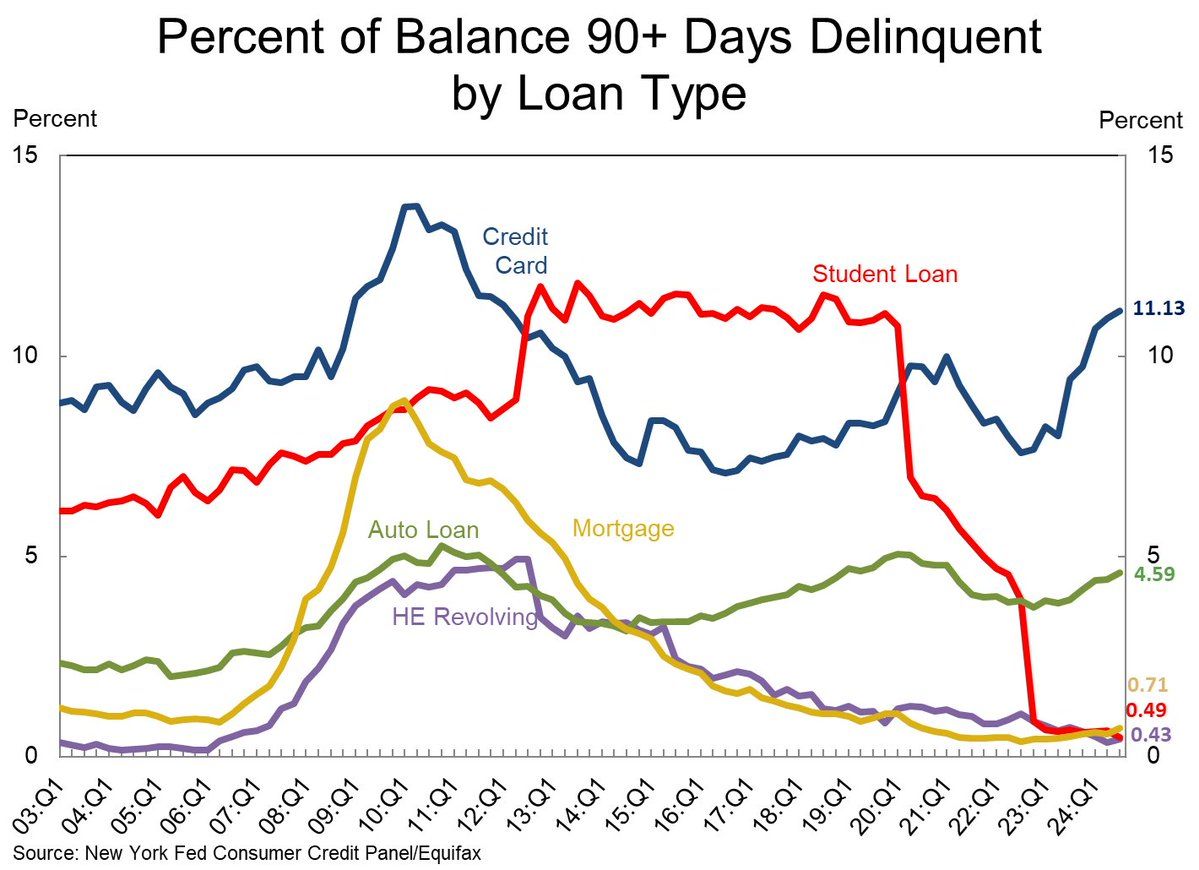

Over 11% of credit card balances in the US are now 90+ days delinquent, the highest since 2012.

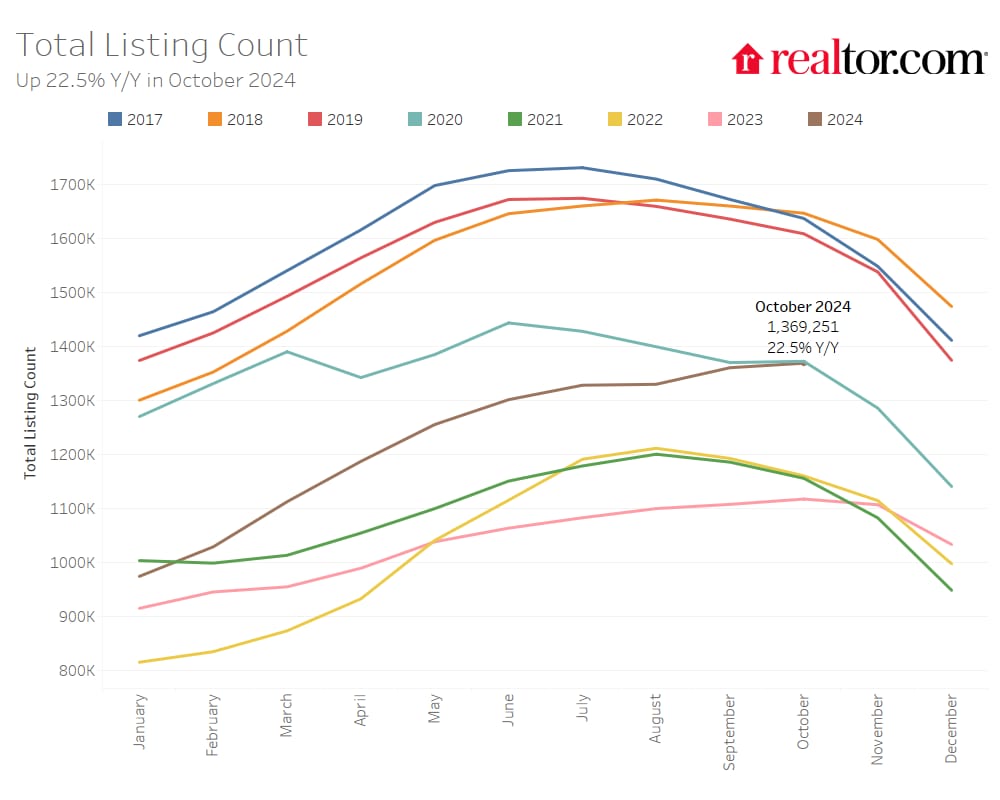

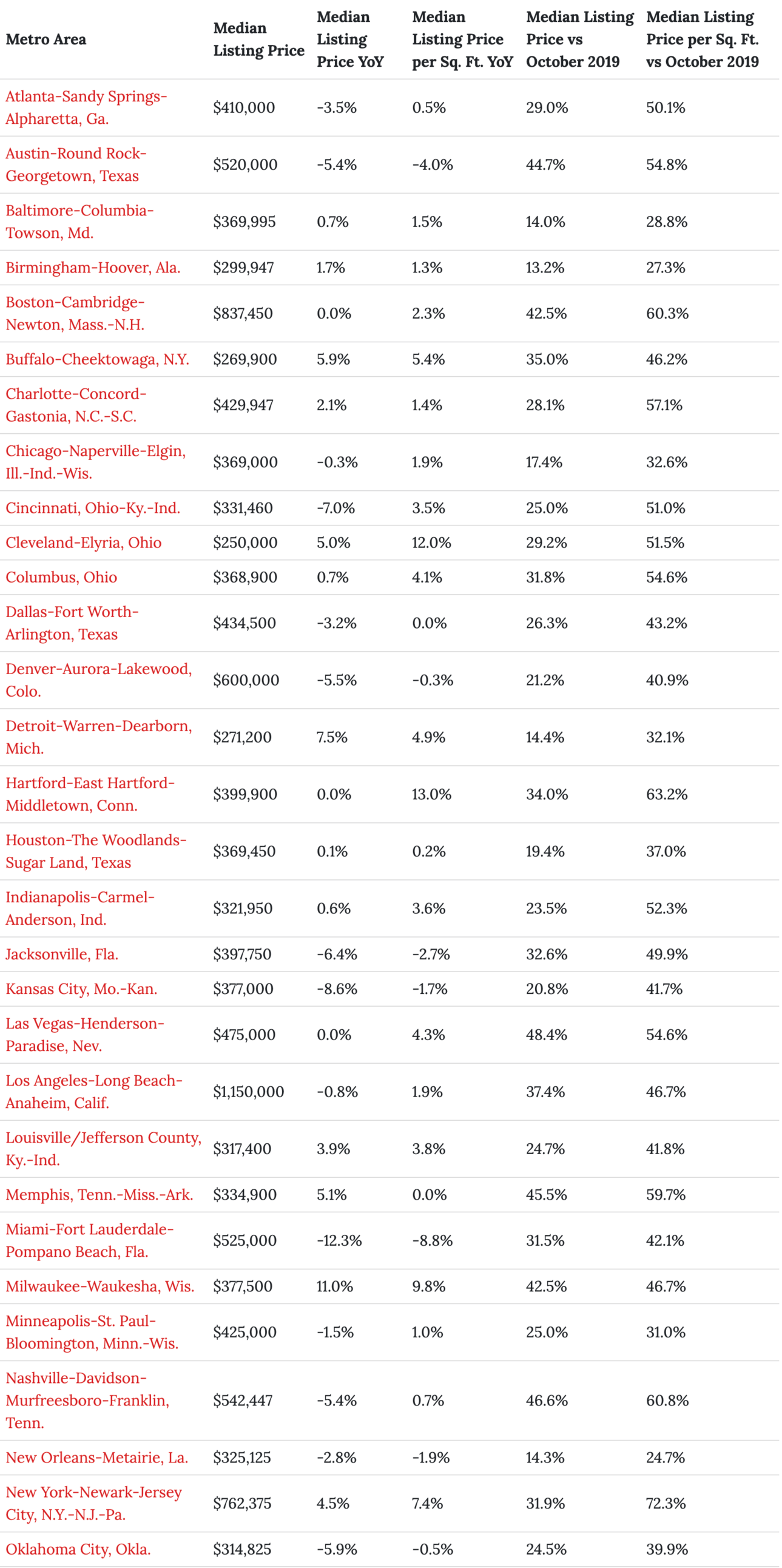

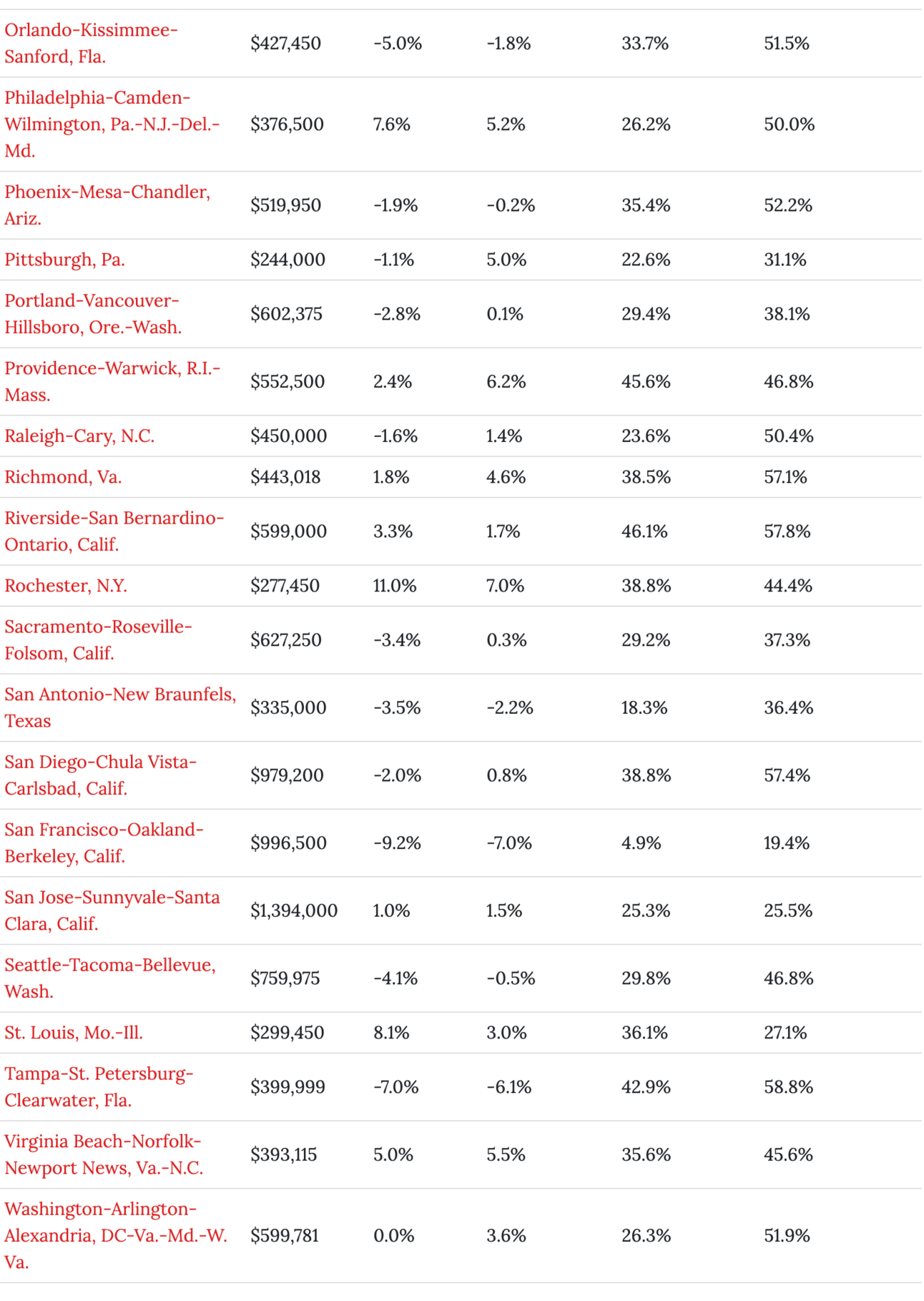

The number of homes actively for sale continues to be elevated compared with last year, growing by 29.2%, a twelfth straight month of growth, and is now highest since December 2019.

The total number of unsold homes, including homes that are under contract, increased by 22.5% compared with last year.

Home sellers increased their listing activity in October, with 4.9% more homes newly listed on the market compared with last year, but this was sharply down from last month as mortgage rates rose to two month highs.

Real estate investment trust JLL Income Property Trust sold an apartment complex in Bothell, just north of Seattle, in one of the suburb's highest-priced multifamily sales of the year.

Acacia Capital Corp., based in San Mateo, California, paid $93.1 million, or $332,500 per unit, to buy for the 280-unit complex at 23028 27th Ave SE, according to Snohomish County property records.

The deal comes as multifamily sales are picking in many parts of the Puget Sound region including the Bothell/Kenmore area

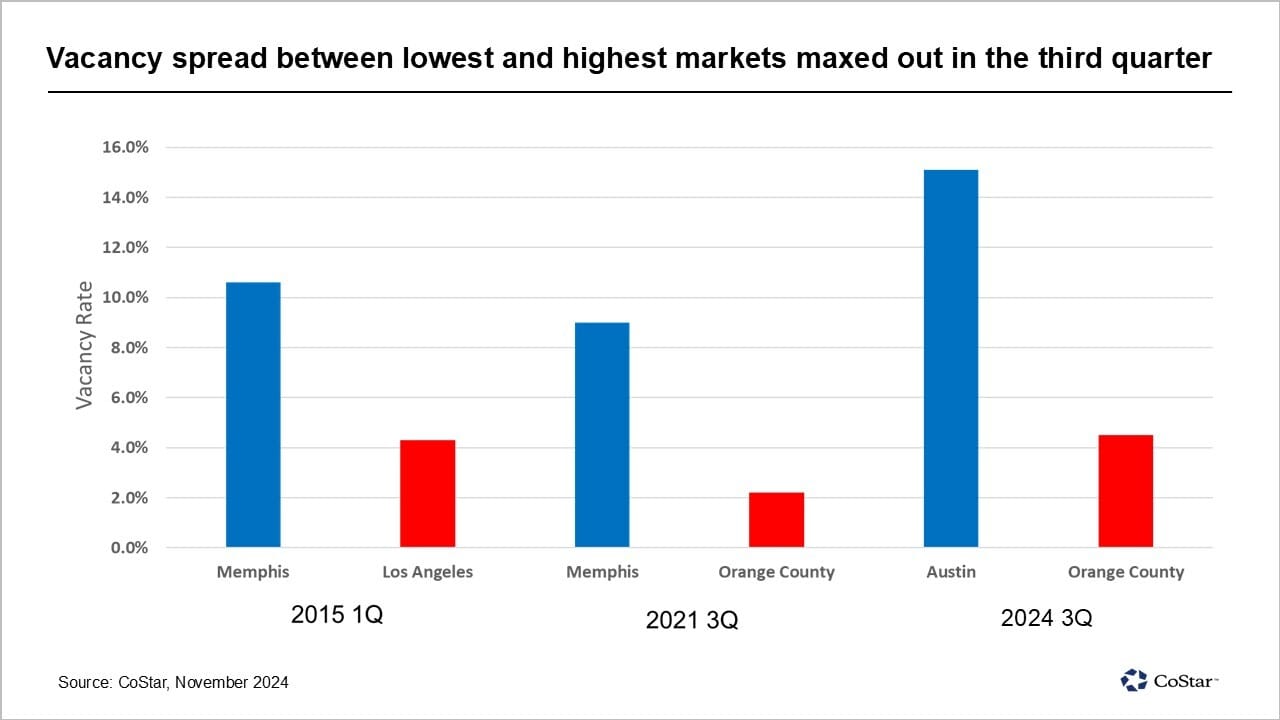

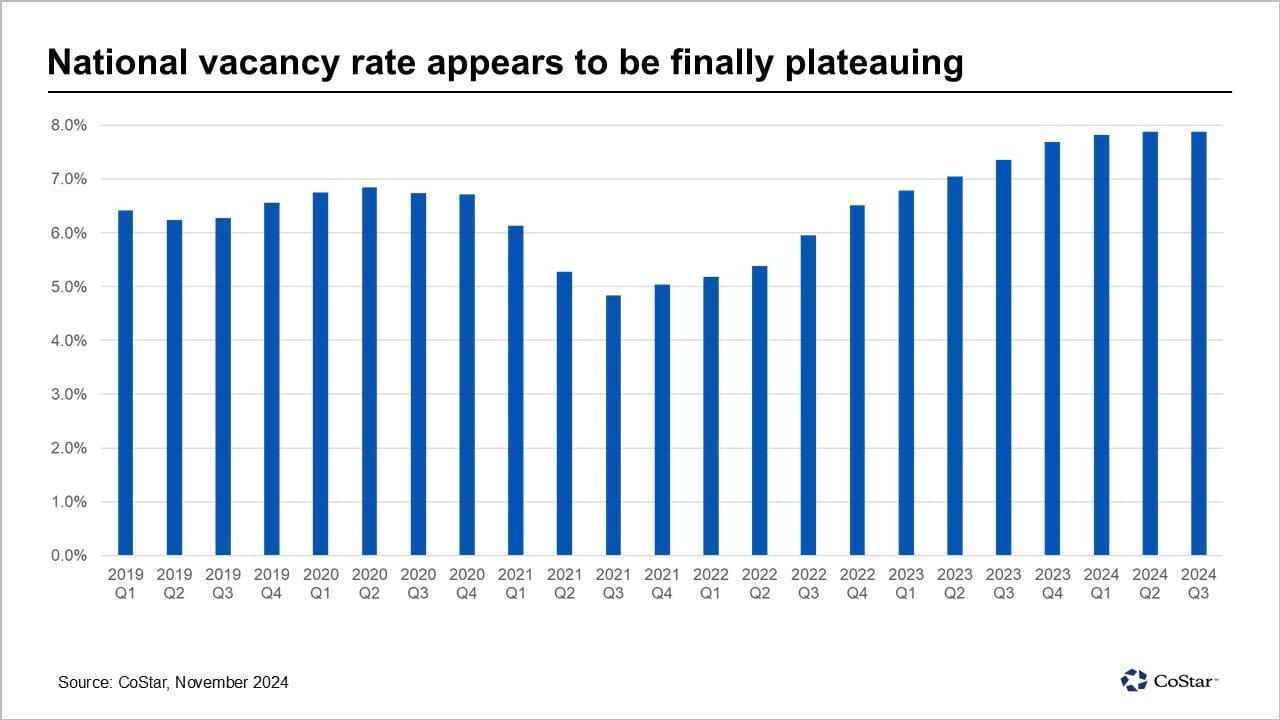

The national multifamily housing vacancy rate may have reached its peak of 7.9% in the third quarter of 2024. This marks a significant milestone as it is the first time in three years that the vacancy rate has not risen compared to the previous quarter.

This trend suggests that the multifamily vacancy rate may finally stabilize following its steep rise from a record low of 4.8% in the third quarter of 2021. Since then, the national vacancy rate has increased by 310 basis points and is 170 basis points higher than the pre-pandemic five-year average of 6.4%.

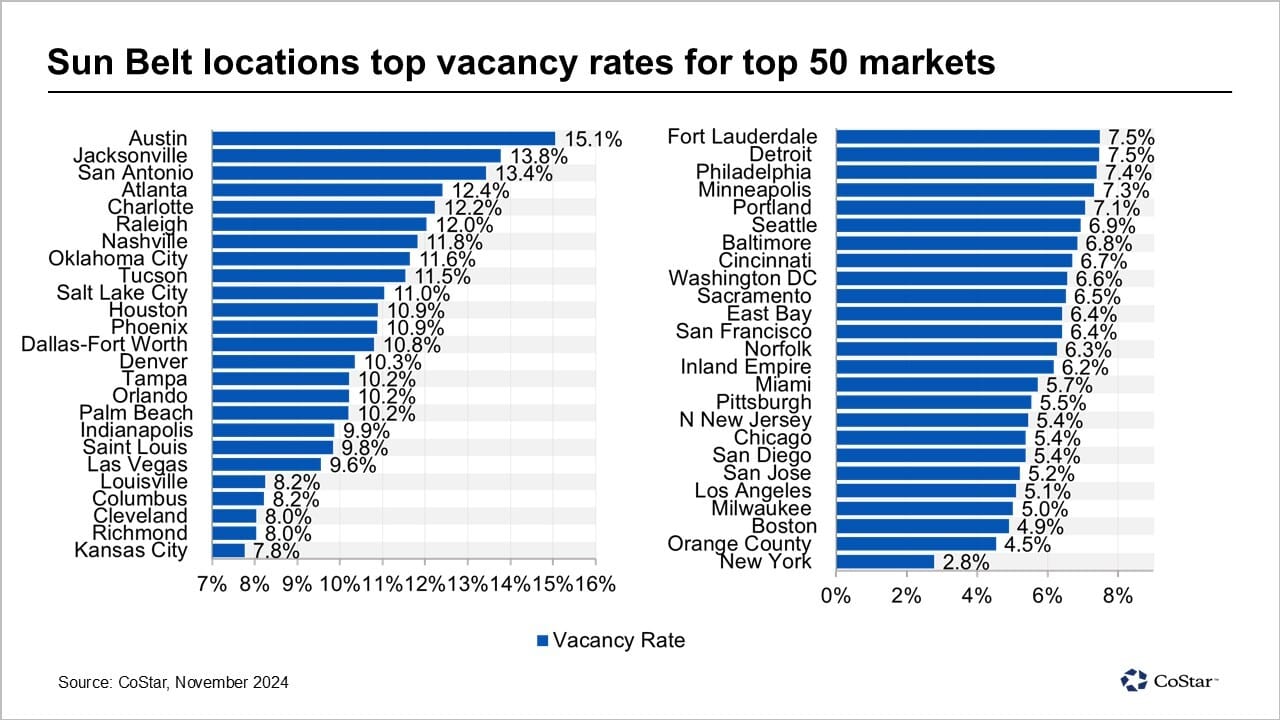

The vacancy rate in Sun Belt markets is disproportionately high, with Austin, Texas, leading the top 50 U.S. cities at 15.1%. Austin is followed by eight other Sun Belt markets with vacancy rates ranging from 13.8% to 11.6%, all well above the national average.

On the other hand, multifamily vacancy rates are lowest in coastal markets and the upper Midwest, with markets like Chicago and Milwaukee ranking among the lowest 10 multifamily markets. New York City has the lowest vacancy rate at just 2.8%, followed by Orange County, California, at 4.5%.