- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Chartbook 11.09.24

Location Strategy Chartbook 11.09.24

Real Estate Market Insights

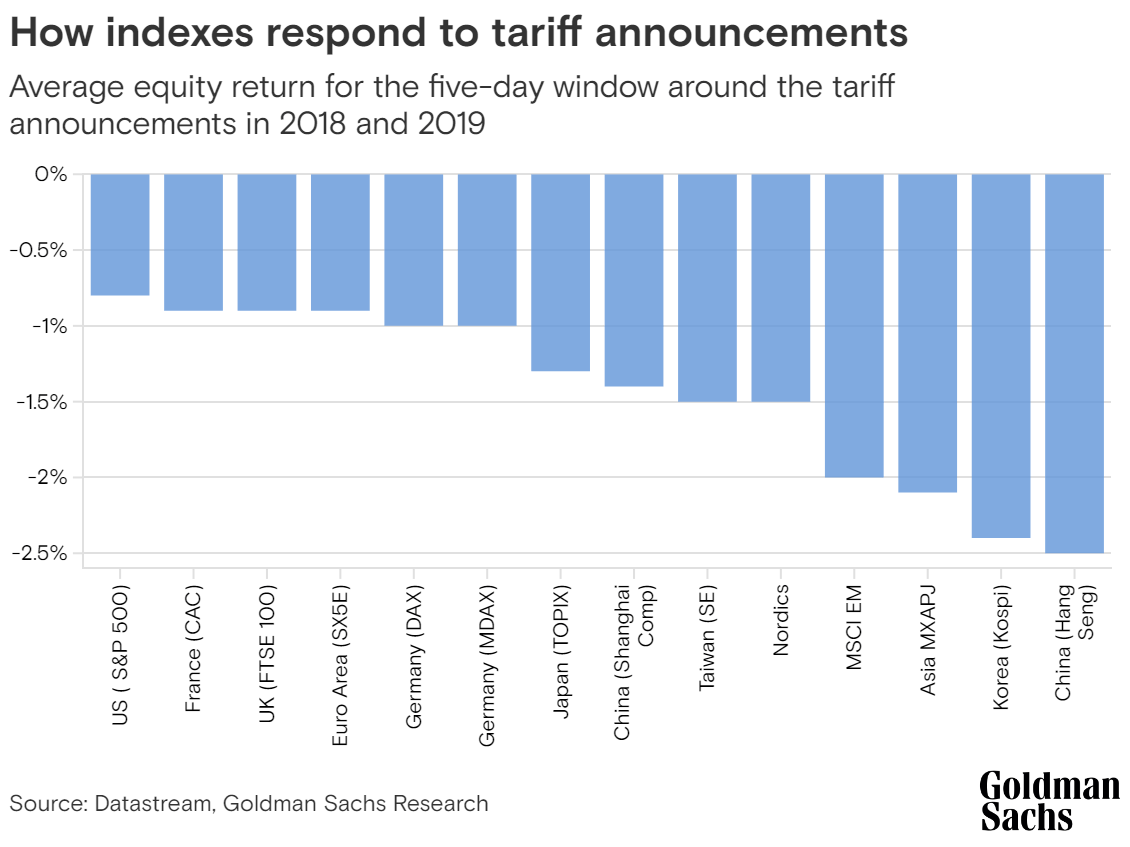

The prospect for trade tariffs is one of the main policy implications that investors are focused on following the election of Donald Trump as US president. His policy proposals include across-the-board tariffs on imports.

European indices, along with China and other emerging markets, tend to be highly sensitive to trade restrictions, according to Goldman Sachs Research. Our economists have also downgraded their forecasts for European GDP growth, reflecting the increase in trade uncertainty and the prospect for increased tariffs. By contrast, US stocks are typically less volatile relative to the broader stock market to changes in world trade.

A paper, published this month by the National Bureau of Economic Research, looks at a period when average tariff rates were some 35% — putting even Trump’s mooted 20% universal import levy in the shade.

What’s especially new about the research by Alexander Klein at the University of Sussex and Christopher Meissner of the University of California, Davis, is their painstaking digitization of data on tariff rates and industry-level data over the period from 1870 to 1900. Earlier analysis used case studies or data modeling.

Their main conclusion: Elevated tariff rates hurt productivity growth. In some sectors, companies were kept in business that otherwise might have been swept away by competition — a sort of analogue to a key criticism of the modern-day policies of ultra-low interest rates and quantitative easing by central banks, generating zombie enterprises.

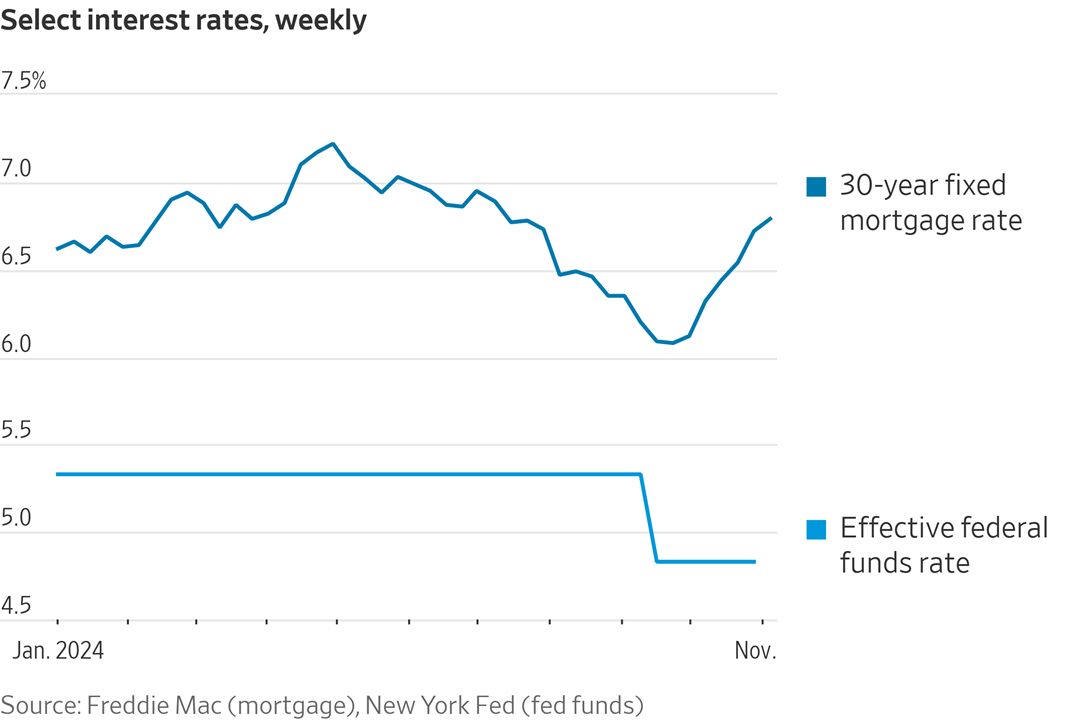

Borrowers aren’t yet feeling the effect of the Fed’s easing. The average rate on a 30-year fixed mortgage has steadily risen since the Fed first cut rates in September.

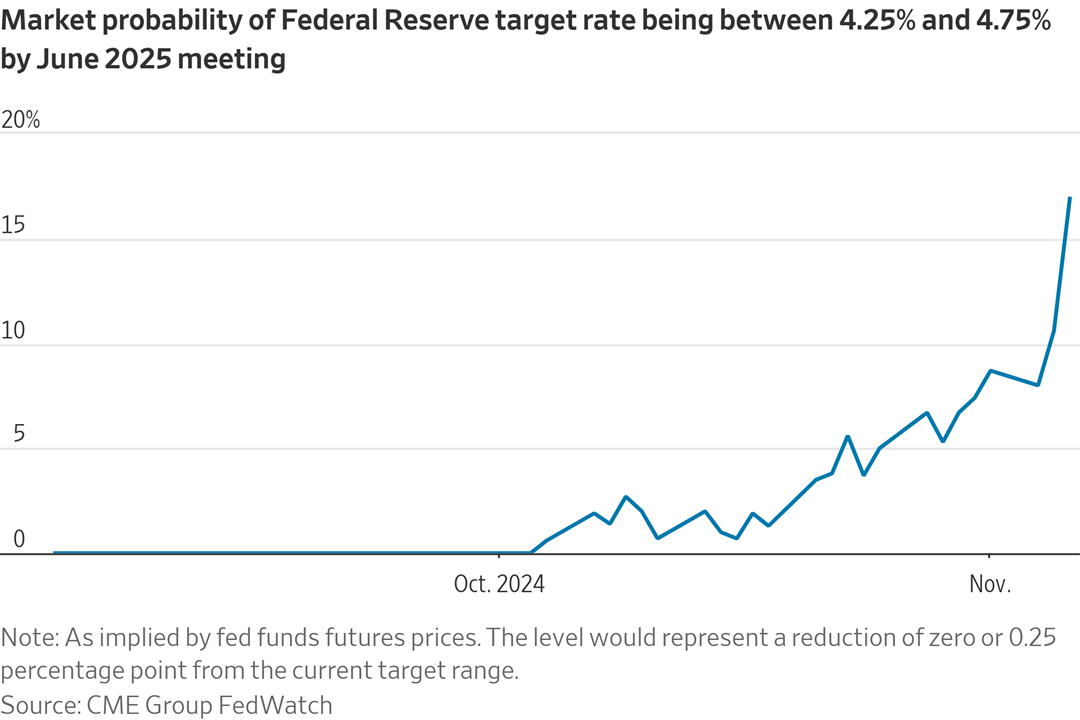

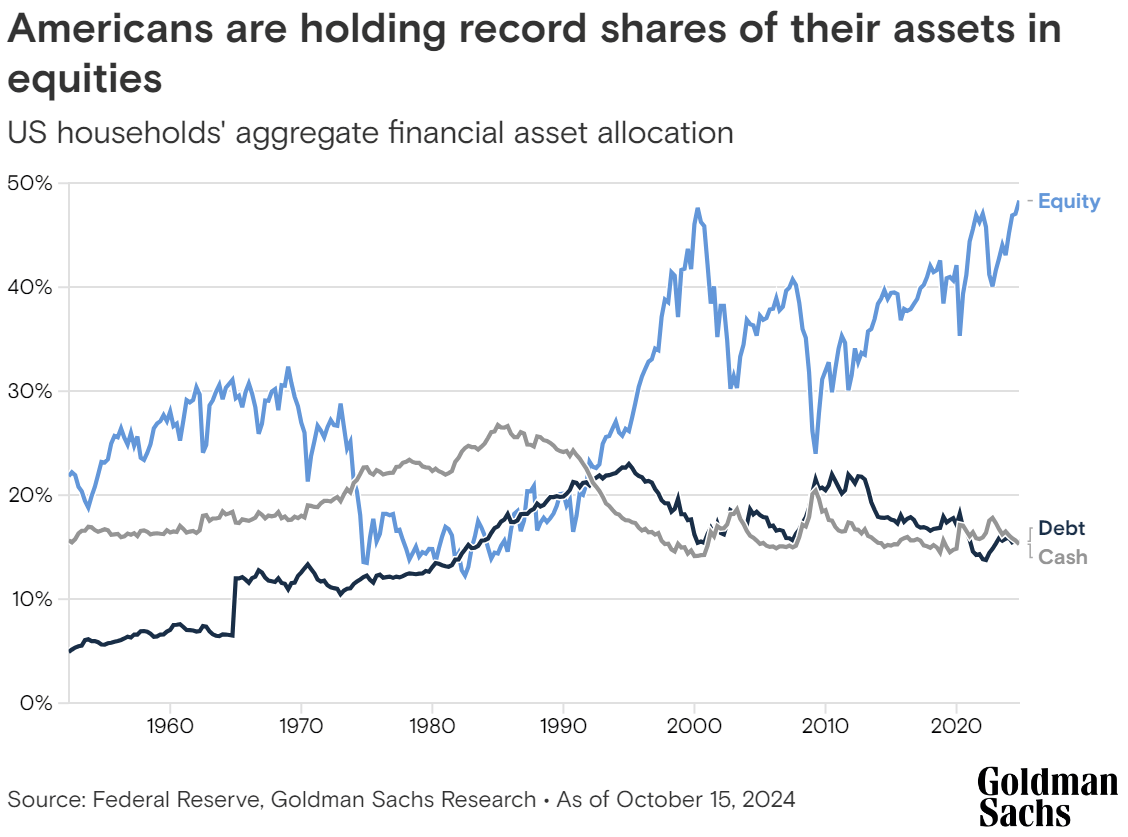

As the Federal Reserve cuts rates, investors may envision a rotation of assets out of money market mutual funds and into equities. But Goldman Sachs Research finds that money market funds typically continue to garner inflows even during cutting cycles, while flows into equity funds ultimately depend on the economic backdrop.

US households held 48% of their financial assets in equities, as of October 15 — a record that equals the previous peak, set around the turn of the century. In contrast, despite strong money market inflows and record assets under management, allocations to cash represent around 15% of households' financial assets – near a record low, according to the Fed's Financial Accounts of the United States.

Allocations to equities are far above the long-term median of 28%. “Household demand for equities has typically been strongest during periods of solid economic growth,” says David Kostin, chief US equity strategist at Goldman Sachs Research. “Although US real GDP growth averaged 2.9% in 2023 and 3.0% in the first half of 2024, the macro narrative has repeatedly shifted from recession fears to growth hopes.”

When the bond market and the currency are giving off conflicting signals about the national debt, trust the currency, Heard on the Street's Jon Sindreu writes. Treasurys are selling off, as a second Trump presidency is set to increase deficits, yet the dollar is strengthening.

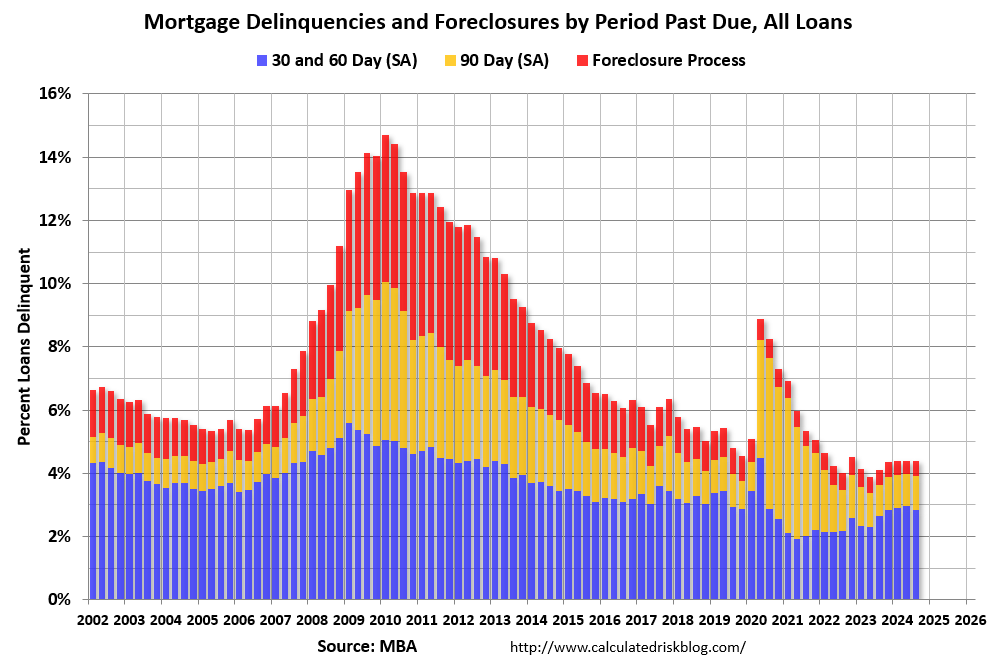

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92 percent of all loans outstanding at the end of the third quarter of 2024 compared to one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 5 basis points from the second quarter of 2024 but up 30 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the third quarter rose by 1 basis point to 0.14 percent.

“Mortgage delinquencies have inched up over the past year,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Even though there was a small, third-quarter decline in the overall delinquency rate compared to the previous quarter, this was driven by a decrease in 30-day delinquencies. Later-stage delinquencies rose last quarter, and overall delinquencies were up thirty basis points from one year ago.”

Added Walsh, “While delinquencies remain low by historical standards, the composition of loans in delinquency is changing, with more 60-day delinquencies and 90-day+ delinquencies across all major loan types, compared to last quarter and one year ago.”

Walsh further noted that the effects of Hurricanes Helene and Milton will likely appear in the next reporting period of the National Delinquency Survey, given the timing of the storms at the end of September and beginning of October.

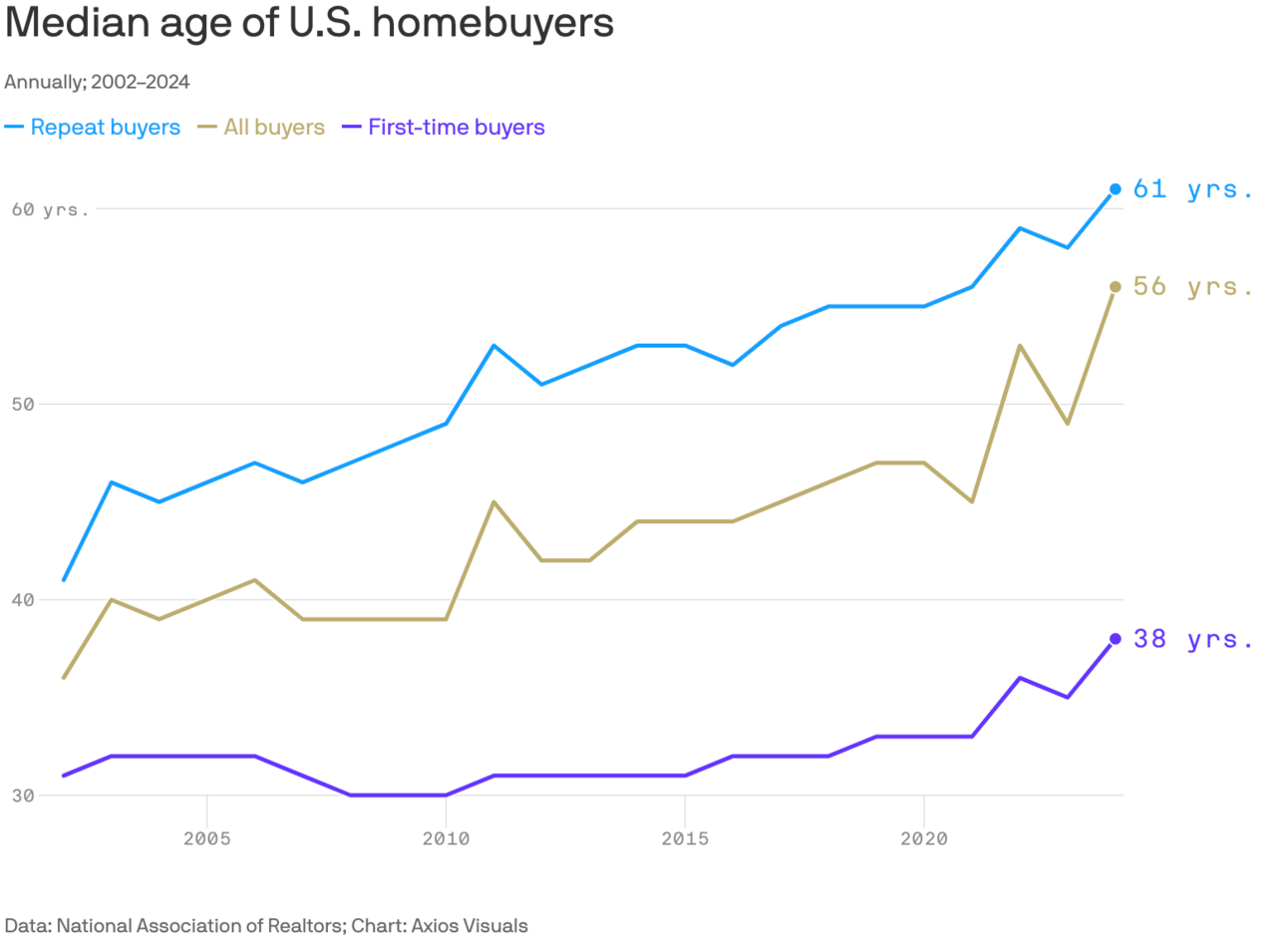

U.S. homebuyers are now the oldest on record, with the median age of first-timers reaching 38, according to a new report. That's up from 35 last year and marks a new high in data going back to 1981, the National Association of Realtors (NAR) announced Monday.

The big picture: Steep housing prices and elevated mortgage rates push homeownership out of reach for many. The share of first-time buyers in the housing market has fallen to a record low of 24%, per the NAR report, which analyzed transactions between July 2023 and June 2024.

The median age of repeat home purchasers rose to 61 from 58 last year — meaning someone taking out a 30-year mortgage could be 91 when the loan matures.

Nearly a third (31%) of repeat buyers paid with cash for their homes, according to the report.

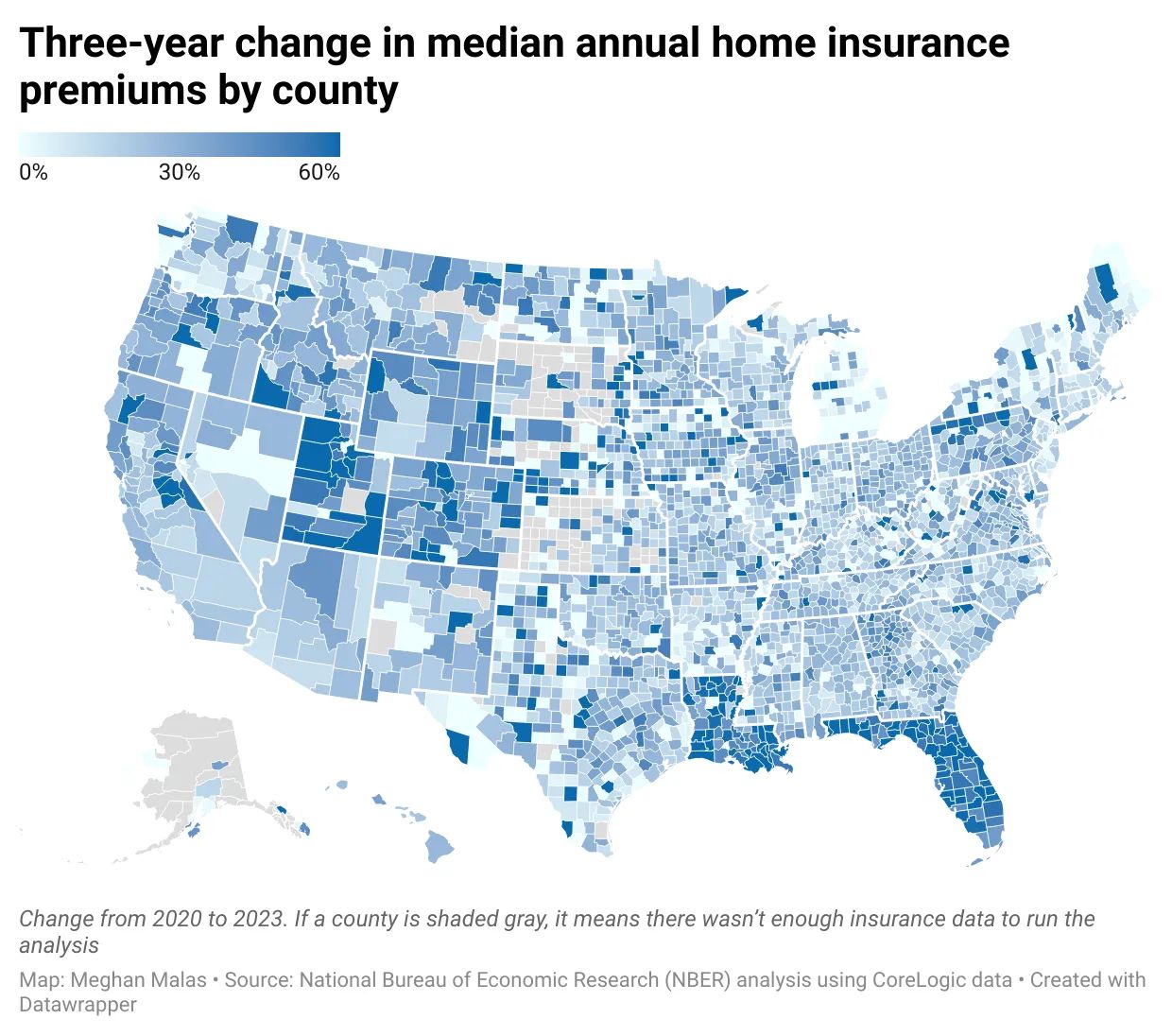

There aren’t many firms that understand how climate risk is impacting the housing market better than CoreLogic, which equips insurers with tools to evaluate and price climate-related risks into home insurance. Through its data, analytics, and risk modeling solutions, CoreLogic enables insurers to assess risks from natural hazards—such as floods, wildfires, hurricanes, and earthquakes.

Over the past few years, the disaster risk that has been modeled and assessed for residential real estate, has put upward pressure on home insurance premiums.

The median annual U.S. home insurance premium rose 33% between 2020 and 2023.

The national median rent dipped by 0.7% in October, as we get further into the slow season for the rental market. The median monthly rent nationally fell by $10, putting it at $1,394, and we’re likely to see that number continue to dip modestly through the remainder of the year.

Since the second half of 2022, the seasonal declines in rent prices that take place during the fall and winter have been steeper than usual and seasonal increases of the spring and summer have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.7 percent and has now been in negative territory for nearly a year and a half. Despite this, the national median rent is still more than $200 per month higher than it was just a few years ago.

National vacancy index ticked up to 6.8 percent, the highest reading since the onset of the pandemic. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over two years amid an influx of new inventory.The third quarter of 2024 saw the most new apartment completions for a single quarter in fifty years, and with more than 800 thousand units still in the construction pipeline, the supply boom has runway to continue into 2025.

Lakevision Capital West, a multifamily investment firm based in San Jose, California, purchased the five-year-old Parkside Esterra Park at 15551 NE Turing St. from Willow Bridge Property Co., an affiliate of Dallas-based Lincoln Property Co., according to King County property records.

The transaction eclipses the $173.8 million sale in July of the Skyglass apartment tower in Seattle’s South Lake Union district as the biggest deal by price of 2024

Asking rents for the apartment property average nearly $2,400 a month, well above the average of just over $2,000 in the Seattle region.

Redmond is also benefiting from investments in transit infrastructure, like the recently opened light rail stations connecting Redmond and Bellevue

Newer properties in Redmond have readily found renters over the past few years, even as a spurt of new construction has pushed the Redmond area’s vacancy rate to about 8% from just over 5% in the past year