- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Chartbook 102624

Location Strategy Chartbook 102624

Real Estate Market Insights

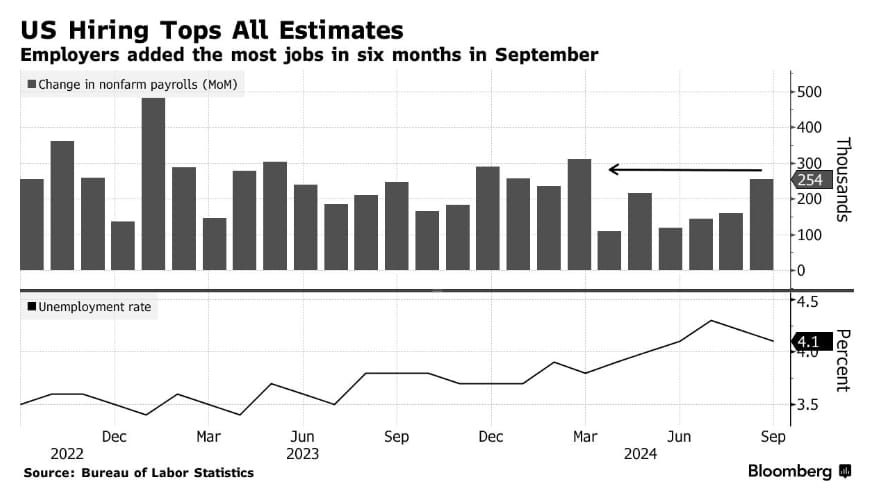

Brisk hiring in the education sector, special outlays ahead of the US election, along with outsize spending to address natural disasters helped to bring joblessness down in September. Take all of that away, and the unemployment rate was 4.23% rather than the 4.05% reported result, they estimated.

What’s the common denominator for labor market strength? Women. Job growth remains driven by a narrow concentration of sectors with leisure and hospitality, education and health, and government adding 190k of the 254k increase in September and over 75% of jobs in the last 12 months. These industries have historically been over-represented by women, and early in the pandemic recovery, these sectors took longer to “catch up” (in terms of employment as they were more likely to be high-touch) than male-dominated sectors like manufacturing and construction, according to BofA Global Research.

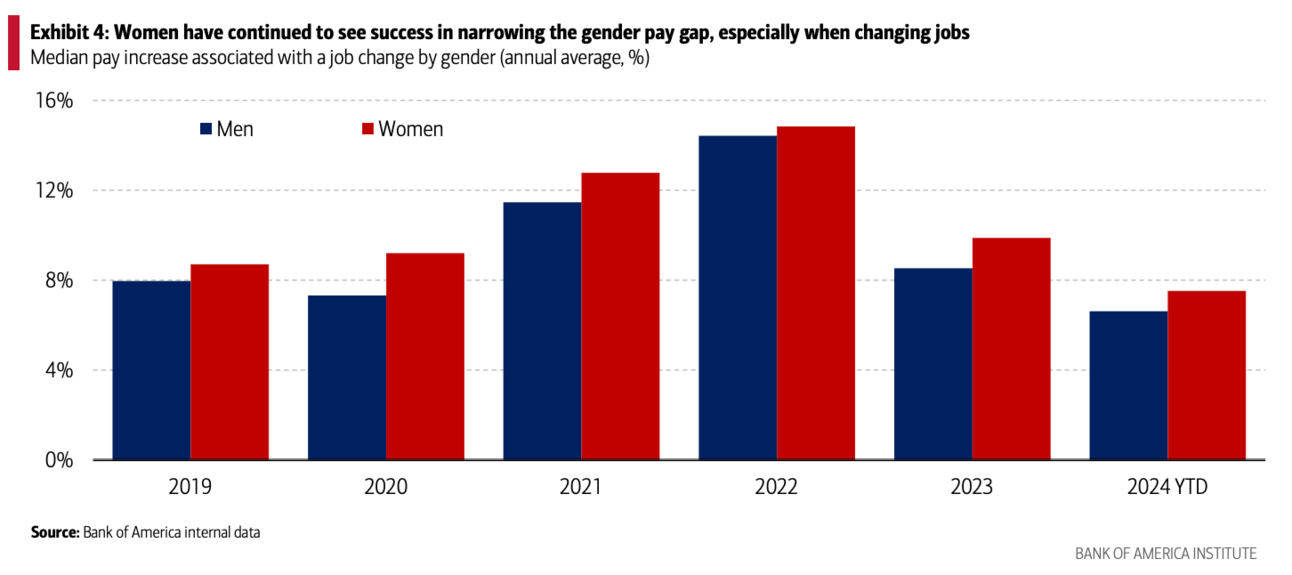

In 2023, women who worked full time in wage and salary jobs had median usual weekly earnings of $1,005, which represented 83.6% of men’s median weekly earnings ($1,202) according to the Bureau of Labor Statistics (BLS).

BofA found women’s median annual income in 2024 has not yet caught up to men’s 2019 average, suggesting more than a five-year lag in pay parity. On a positive note, women’s median annual income has been rising faster than men’s since 2020, so it’s likely that this gap will continue to narrow.

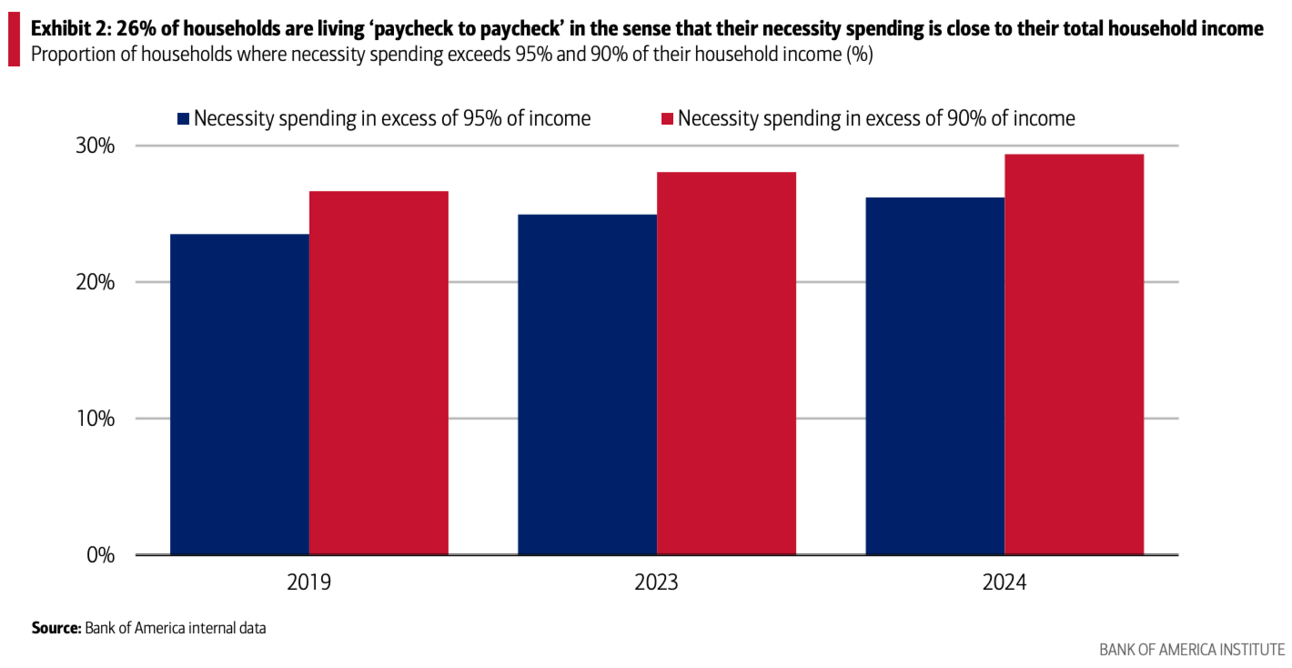

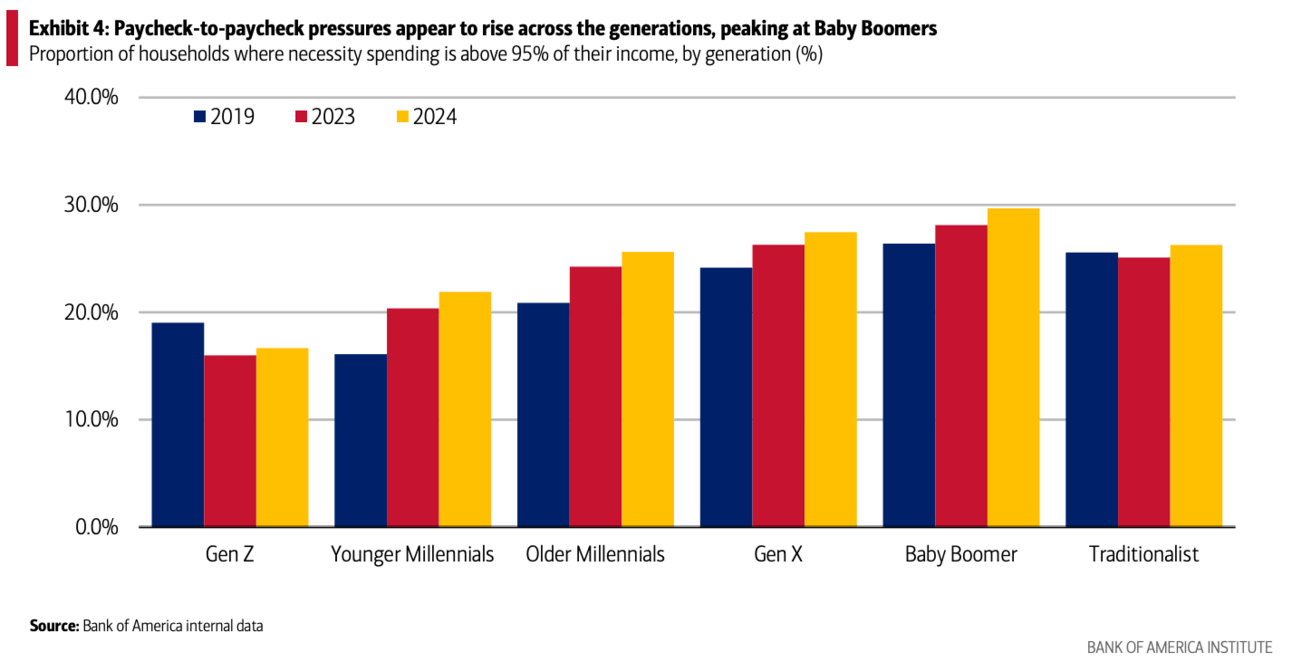

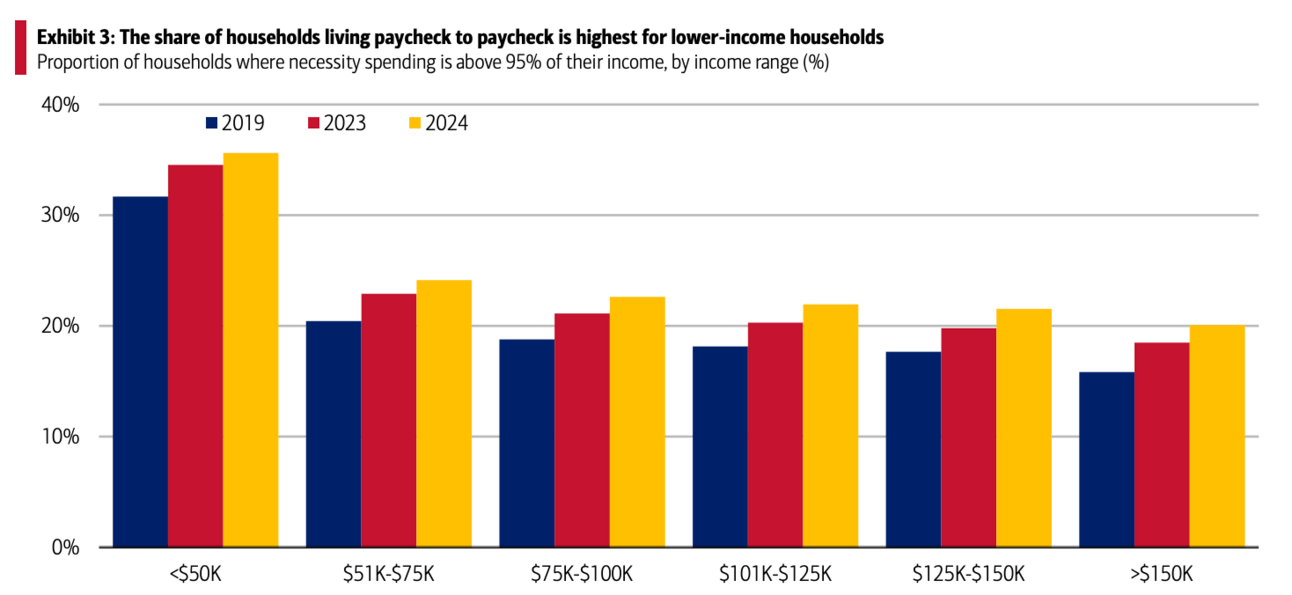

A large proportion of Americans perceive themselves to be in the ‘paycheck to paycheck’ camp. For example, the Bank of America Market Landscape Insights Study regularly asks people if they agree with the statement ‘I am living paycheck to paycheck’ and in the third quarter of 2024 almost half of survey respondents agreed with this statement, either strongly or somewhat. It also appears the paycheck to paycheck proportion of respondents has been rising over at least the last two years which likely reflects the impact of higher consumer prices on people’s perceptions and experiences of their finances

BofA evaluated account holders that appear to have their primary banking relationship with the bank. They considered a fairly broad measure of necessity spending, covering areas such as gasoline, food and utility bills, as well as general retailers, internet service provider subscriptions, public transportation and childcare.

BofA’s central estimate of the proportion of households living paycheck to paycheck is based on the proportion of households where necessity spending is more than 95% of their household income, leaving them relatively little left over for ‘nice to have’ discretionary spending or saving. As a sensitivity, we also look at the share of households where necessity spending is more than 90% of their household income.

Over a quarter of households in 2024 so far would be classified as living ‘paycheck to paycheck’ for the ‘95%’ threshold criteria. On the broader ‘90%’ criteria this rises to around 30%.

Around 35% of households with incomes below $50K a year are living paycheck to paycheck, up from 32% in 2019.

More surprising is that the proportion of households appearing to live paycheck to paycheck falls only slowly as incomes rise.

Around 20% of households with incomes above $150K also appear to be living paycheck to paycheck

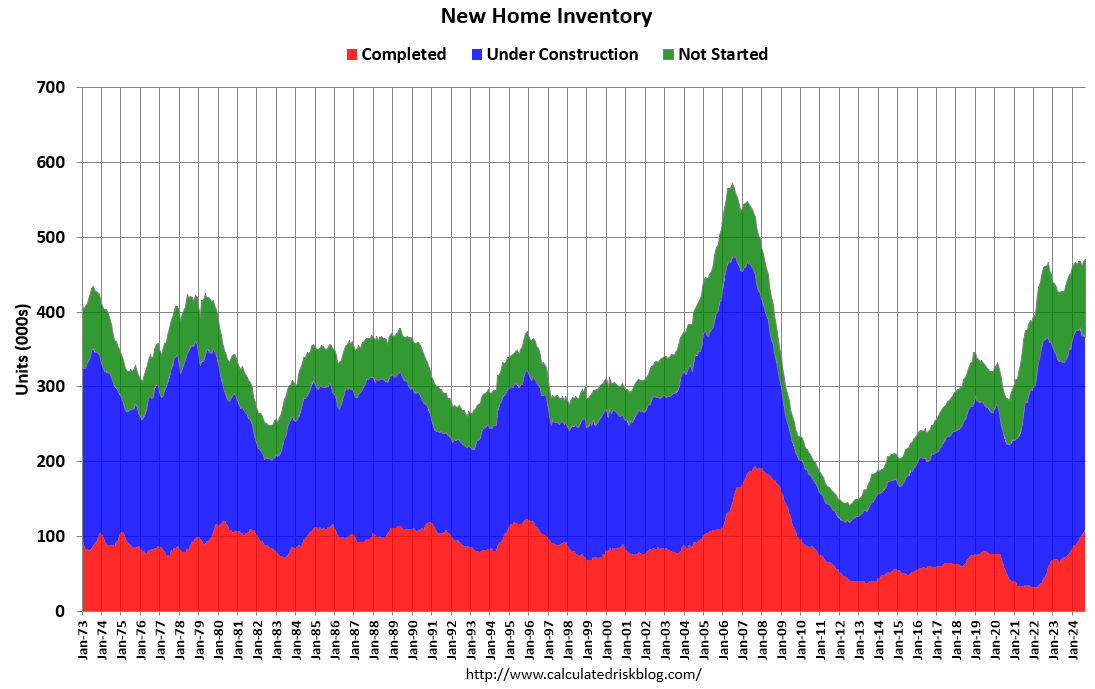

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed. The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale (red) - at 108k - is more than triple the record low of 31k in February 2022. This is the most since 2009, but still close to the normal level of completed homes for sale.

The inventory of homes under construction (blue) at 258k is very high but is about 19% below the cycle peak in July 2022. The inventory of homes not started is at 104k - this is the all-time high.

The share of homeowners with higher mortgage rates is climbing as people tap equity via refinance but of course new homes are still selling. For new homebuilders, the good news with high rates is less competition with existing homes as they turnover is low with homeowners locked in

A 4.75 acre mixed use development is coming to Henderson Avenue in Dallas in 2026.

10 buildings + public spaces will span about 161,000 square feet: 12,000 square feet of restaurant space, 75,000 square feet for retail and 74,000 square feet of office space.

The new development will include new street paving, decorative crosswalks and landscaping, and will bury utility lines. There will also be 500 underground parking spaces.

The goal is to create "one of the most appealing stretches of walkable retail in Dallas and feature dozens of the most exciting contemporary retail brands in North America, many of which will be new to Dallas," according to Mark Masinter, managing partner and co-founder of Ignite-Rebees and Open Realty.