- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Chartbook 03.15.25

Location Strategy Chartbook 03.15.25

Real Estate Market Insights

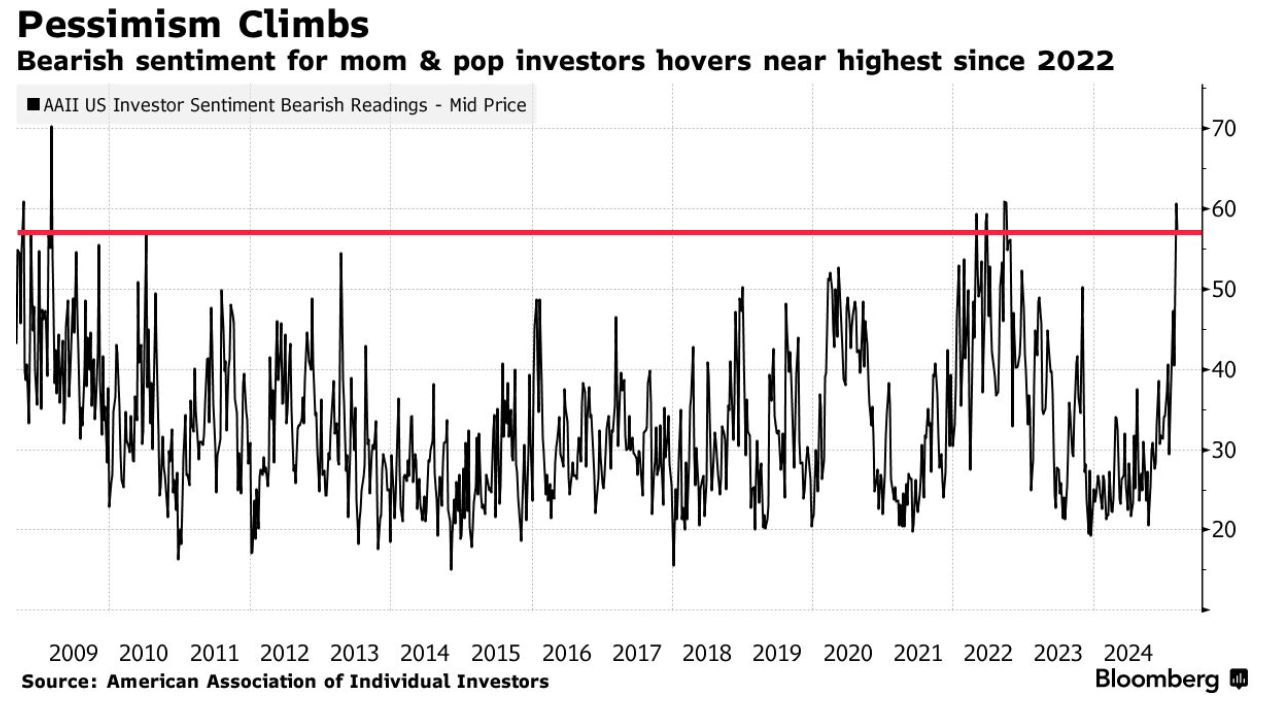

Inflation remains sticky, unemployment is rising amid the Trump administration’s efforts to slash the federal payroll and growth is slowing from its previous breakneck pace. The combination is leading economists and sell-side strategists to warn about a bumpy road ahead. “The stock market is very confused about Trump’s tariff plans,” said Jeremy Siegel, a finance professor at University of Pennsylvania famous for, among other things, calling technology shares “a sucker bet” in March 2000 as the dot-com bubble was peaking. “Is all of this just a negotiating tactic? We don’t know yet. I see an even bigger correction coming after over-exuberance.”

“Risks are rising, and we’re starting to question the potential rockiness in the economy,” said Lori Calvasina, head of US equity strategy at RBC Capital Markets. “We’re at a tricky spot. And the next few weeks are pivotal.”

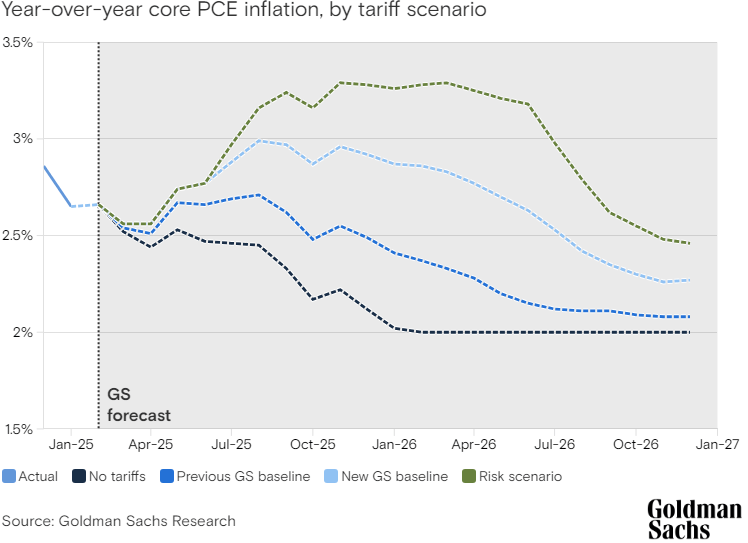

Goldman Sachs Chief US Economist David Mericle: our economists now expect that the average US tariff rate will increase by 10 percentage points or more, which is likely to boost consumer prices.

The higher tariff assumptions imply that that the Federal Reserve's preferred measure of inflation, core PCE, will rise to about 3%. While tariffs on their own represent only a one-time change to the price level rather than a more meaningful shift in the pace of inflation, he says the risk that trade policy concerns spark broader changes to inflation expectations bears watching, given the attention from both consumers and businesses. “It is, I think, a little bit of surprise relative to what I might've expected several months back, just how focused businesses and consumers are on tariffs,” Mericle says. “I would say at the very least this is something to keep an eye on — the risk of the tariffs sparking broader price increases.”

The larger tariffs are also likely to weigh on economic growth, says Mericle, whose team cut its 2025 GDP growth forecast on a Q4/Q4 basis from 2.2% to 1.7%. In addition to the tax-like impact of tariffs on disposable income and consumer spending, “the uncertainty that tariffs introduced are probably going to have a larger effect, discouraging business investment [more] than I would've thought a couple of months ago,”

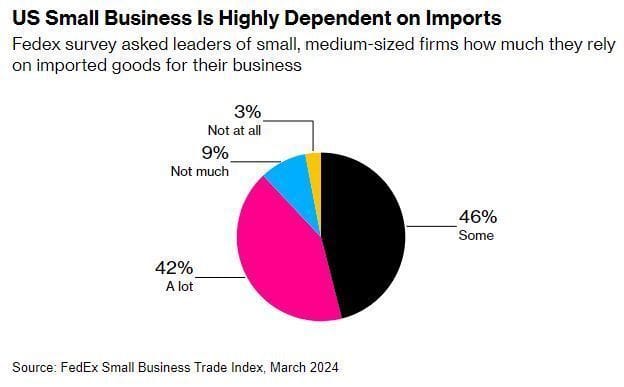

Fedex: More than two-thirds of U.S. SMB leaders rely on imported goods for production or as merchandise to distribute domestically. These businesses report they export products that utilize imported materials, and 82% say the ability to import products or components from overseas directly supports jobs within their company. The majority of SMB leaders believe expanding trade to customers in other countries is a good thing, with approximately 9 in 10 identifying that the most important countries to maintain trade with are Japan, the United Kingdom, and China.

46% of Americans work for small businesses

WSJ: Global insured losses from natural disasters reached $145 billion, more than 50% above the 21st- century average, according to the brokerage and risk manager Aon. Yet over the past couple of years, insurers have successfully asked state regulators for permission to raise rates to compensate for higher loss costs, and those increases are now flowing through results. The average annual property insurance premium for single-family homes with mortgages was up a record $276 in 2024, or 14%, according to Intercontinental Exchange’s ICE Mortgage Monitor. Motor-vehicle insurance costs were 12% higher in January than a year prior, according to the Labor Department’s consumer-price index.

Berkshire Hathaway has long made collecting insurance premiums, including through Geico, a key part of how it funds its investments. In his 2024 shareholder letter, Buffett wrote that Geico has been “increasing efficiency and bringing underwriting practices up to date.” He wrote: “Though not yet complete, the 2024 improvement was spectacular.” Geico’s pretax underwriting profit was $7.8 billion last year, up from $3.6 billion in 2023 and a loss in 2022.

Industrywide, the personal auto combined ratio—a measure of what an insurer pays out in claims and related expenses, as a percentage of premiums—is estimated at 98.8% for 2024, according to data compiled by the Insurance Information Institute. That represents an improvement from about 105% in 2023, and north of 110% in 2022. And investors are jumping on the bandwagon. So far in 2025, P&C insurers in the S&P 500 are up about 7%, compared with declines for banks and the broader index.

Chicago led all metropolitan areas of the country with 582 qualifying real estate relocation and expansion projects in 2024, according to results announced Monday by relocation industry publication Site Selection. It won that category for the 12th consecutive year despite economic challenges faced by the region and state, up from 485 eligible projects in 2023.

The broader Dallas area had 489 qualifying projects, up by 37 from the year earlier, and Houston had 435, an increase of 22, to finish second and third.

Those markets helped lead Texas to the statewide title, known as the Governor’s Cup, for the 13th year. Texas had 1,368 qualifying projects, an increase of 114. That easily topped second-place Illinois’ 664, which was 112 projects more than in 2023. Ohio was third with 565, up by 103, and California was fourth with 323, a decrease of 52 projects.

The competition includes only deals that meet certain parameters — private-sector investments that involve an investment of at least $1 million, the creation of at least 20 new jobs or an expansion by at least 20,000 square feet of space — but the competition provides bragging rights and a potential edge for cities, regions and states competing for jobs.

"The New York Stock Exchange's move from Chicago to Dallas is a huge win, and Fisher Investments moving its headquarters from Washington to Texas is also a big deal. Texas keeps hitting a lot of home runs."

Houston has attracted big relocations, including Chevron and Hewlett Packard Enterprise, due to the city's concentration of employees in the energy industry and its tech focus. Likewise, Dallas has landed some major financial services firms, including Goldman Sachs and Wells Fargo, which are both developing major office hubs in the area that has become known as "Y'all Street," by those in the community.

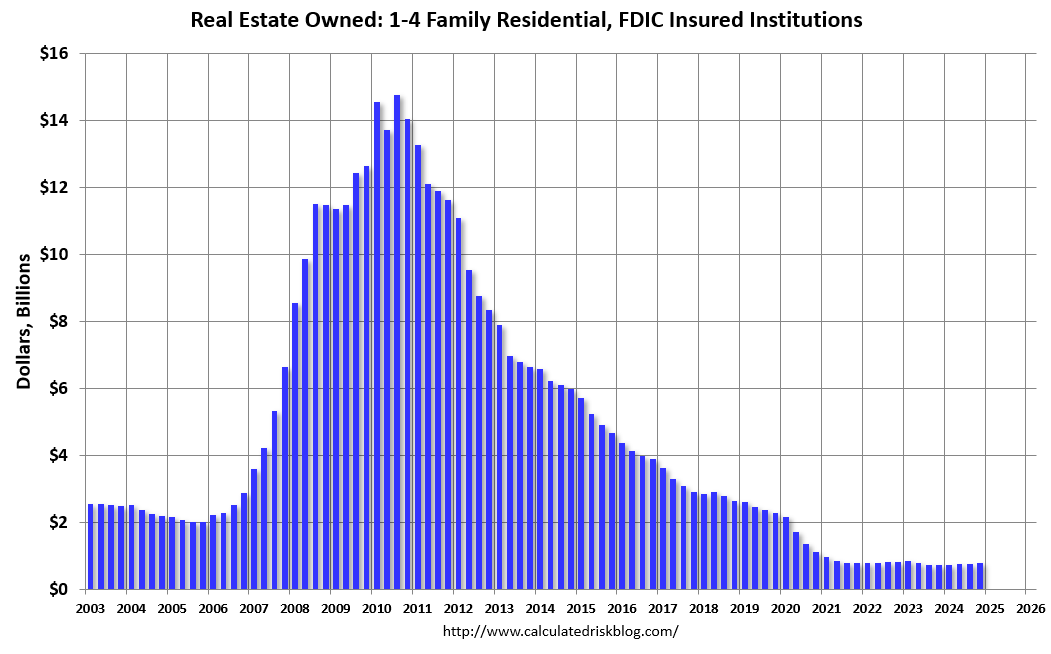

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) was increased 6% YOY from $747 million in Q4 2023 to $790 million in Q4 2024. This is still historically extremely low.

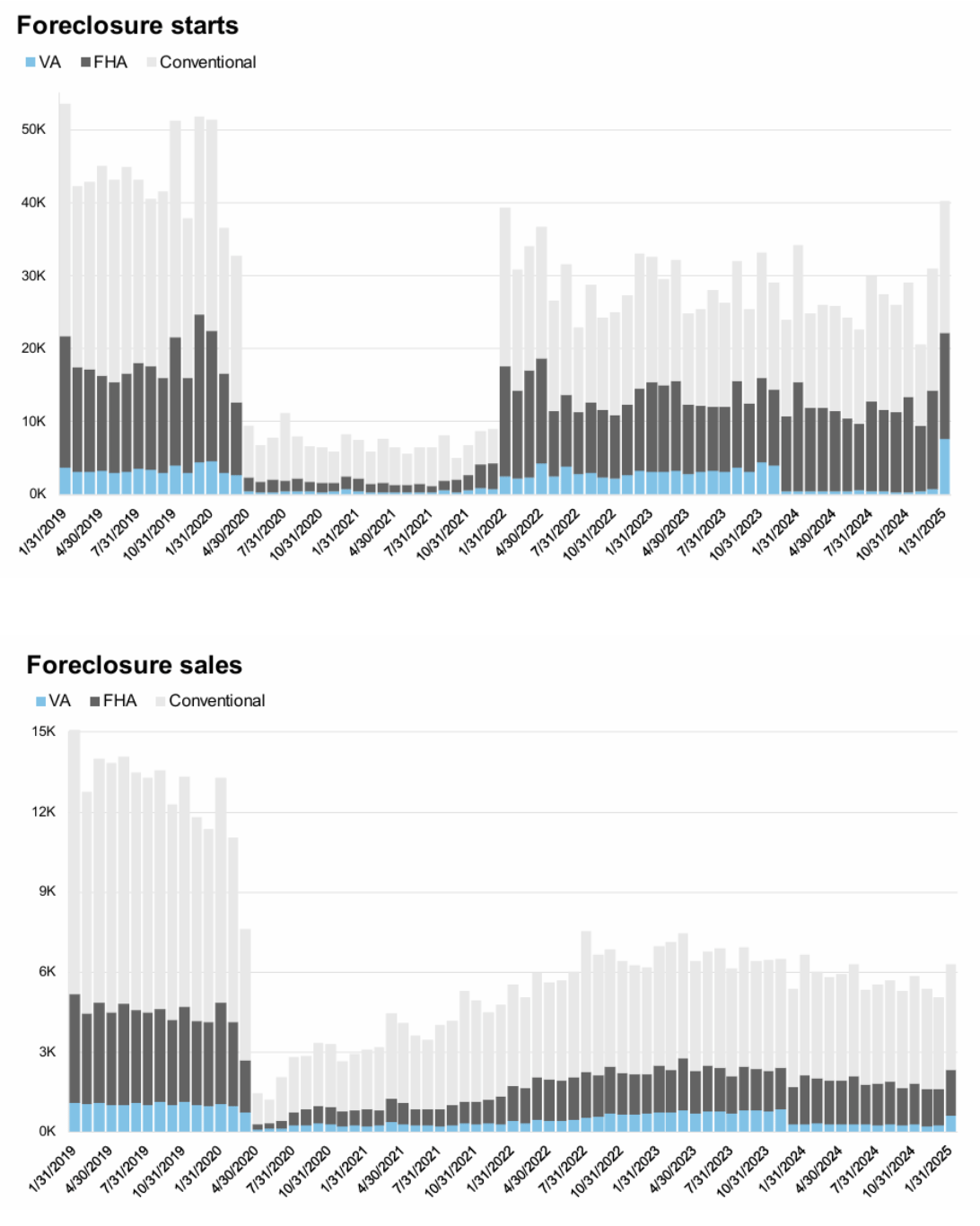

ICE reported that foreclosures starts and sales have increased recently, especially for VA loans, however foreclosure sales are still down year-over-year.

Foreclosure starts jumped by 30%, sales rose by 25%, and the number of active foreclosures rose by 7% in January following expiration of a recent moratorium on VA foreclosures.

While January increases in foreclosure activity are common, starts hit their highest level in 5 years, with more than 40K loans referred to foreclosure in the month.

Compared the same time last year, foreclosure starts among FHA (-2%) and conventional (-4%) loans declined, with the annual increase being solely driven by the spike in VA referrals.

Resumption of VA foreclosures – all else the same – could result in a roughly 15% increase in 2025 foreclosure referral activity compared to 2024 January foreclosure sales rose from December following holiday moratoriums, but were down from the same time last year (-5%) even with the resumption of VA foreclosure sales.

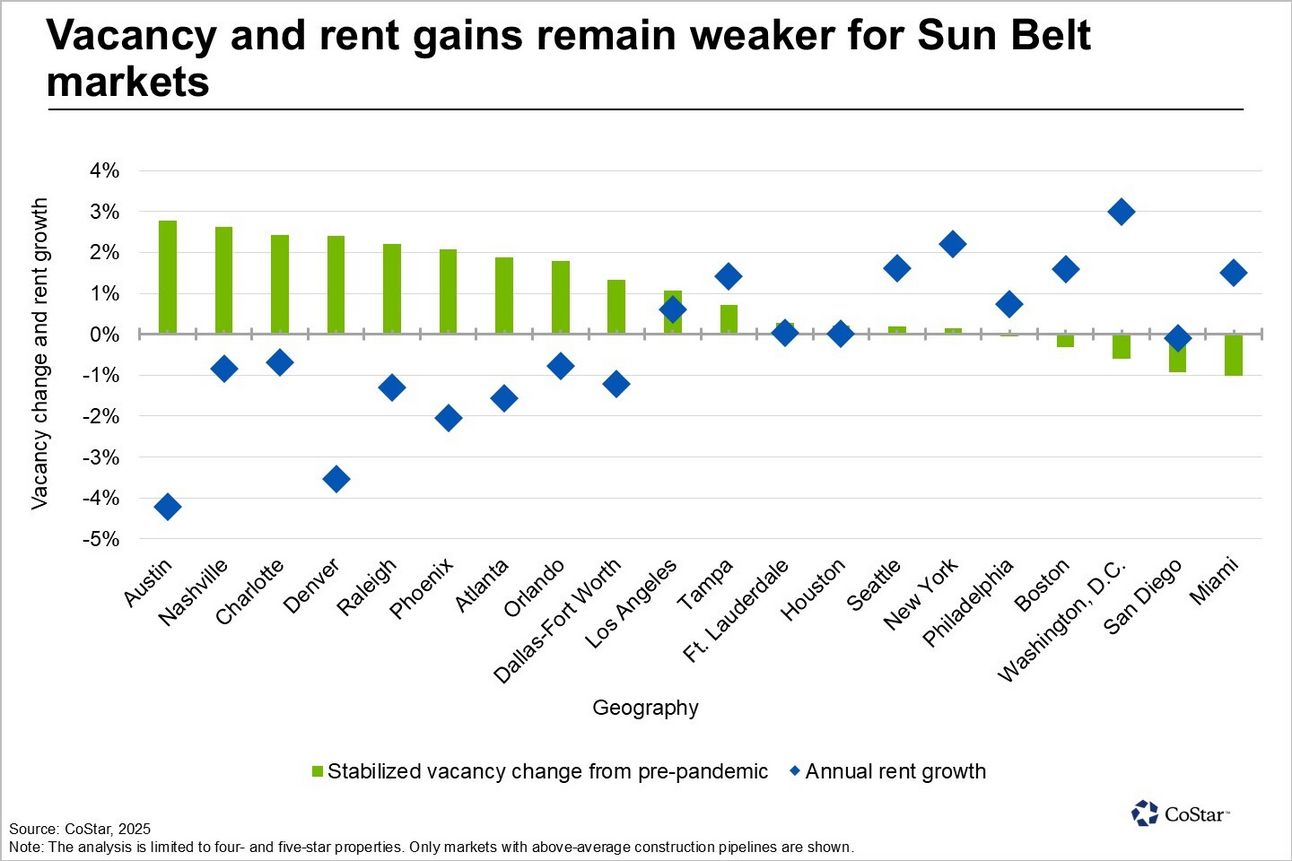

Luxury rent growth, defined as rent in four- and five-star-rated apartments, has contracted the most in several Sun Belt markets, including Denver, Phoenix and Austin, Texas. They continue to see significant apartment construction pipelines, resulting in a larger oversupply.

Nashville, Tennessee, Charlotte and Raleigh, North Carolina, Atlanta, Orlando, Florida, and Dallas have seen an expansion in stabilized vacancy relative to their pre-pandemic levels and a contraction in rent gains, although not as dramatic as in Denver, Phoenix and Austin.

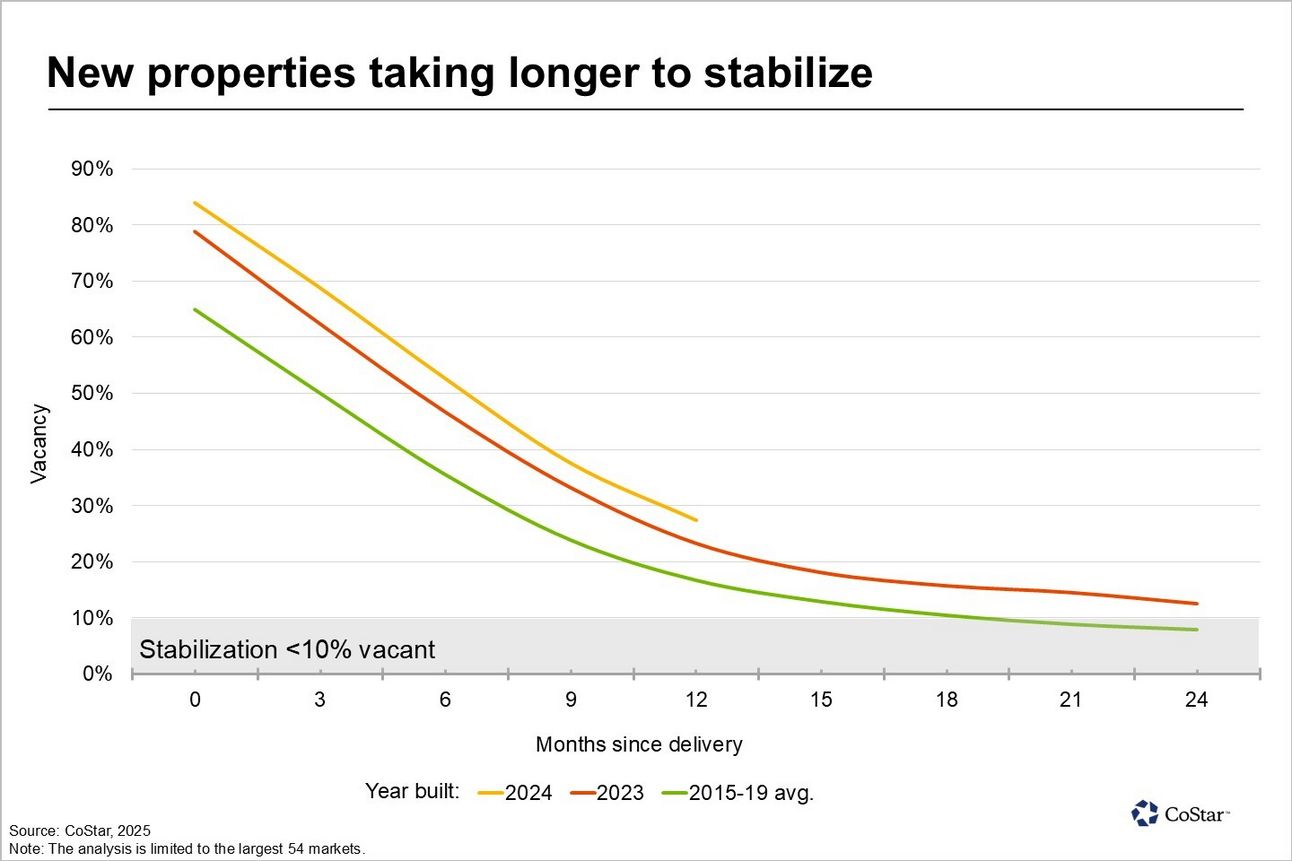

New apartment properties are taking longer to lease up despite flat to negative asking rents and one to two months of free rent becoming a staple over the last year.

Nationally, properties delivered in 2024 remain around 30% vacant 12 months after delivery, as shown by the yellow line in the chart above.

2023-built properties were less than 25% vacant, and 2015-to-2019-built properties, which were less than 15% vacant 12 months after delivery, as shown by the red and green lines above.

Multifamily properties built in the last couple of years take around two years to reach stabilization, assuming this takes place at a 10% vacancy rate or lower.

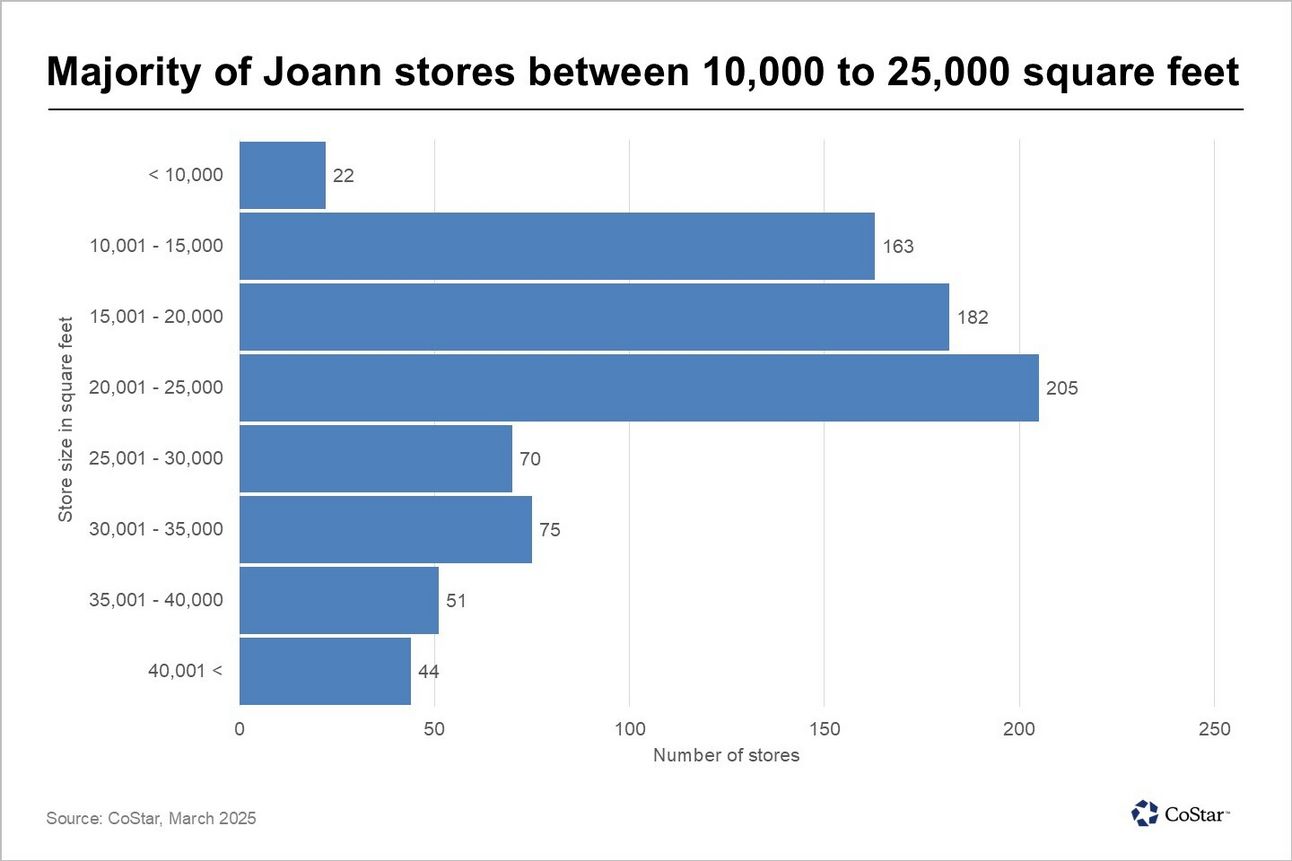

Joann Fabrics is winding down operations after more than 80 years in business. The craft chain's liquidation will bring approximately 18.5 million square feet of store space spread across 800 locations will be brought to market. The largest concentration of Joann stores is in the Northeast, with 30%, while 25% are in the South and 22% in the Midwest and Western regions.

While the average Joann store is just over 22,700 square feet, the stores range from as small as 5,000 square feet in Amsterdam, New York, to over 55,000 square feet in Altamonte Springs, Florida. The vast majority of stores are between 10,000 and 25,000 square feet. Joann leased all its retail portfolio, most of which are located within three-star-rated community and power centers with multiple anchors.

While just over half of Joann's landlords are smaller private investors, the greatest impact is expected to be felt by REITs and institutional investors, which have a combined 40% of Joann locations in their portfolios, nearly twice their 21% ownership share of the overall retail market.