- Location Strategy Top 10 Chartbook

- Posts

- Location Strategy Chartbook 01.04.25

Location Strategy Chartbook 01.04.25

Real Estate Market Insights

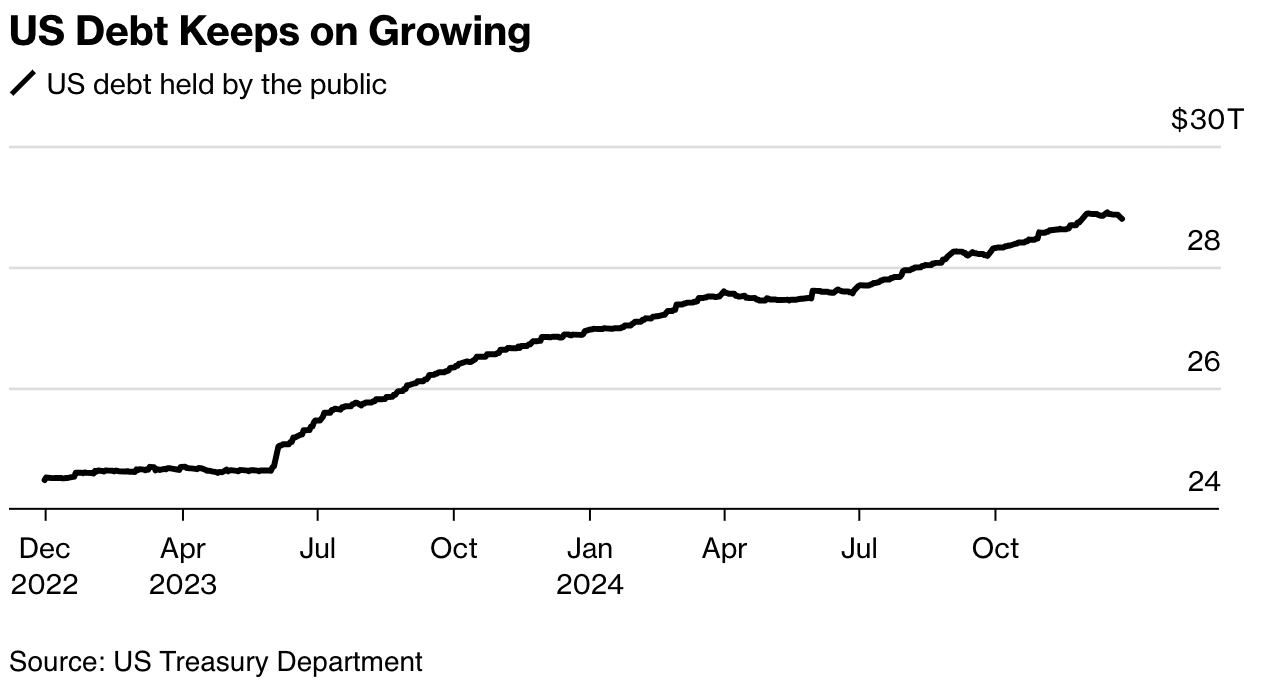

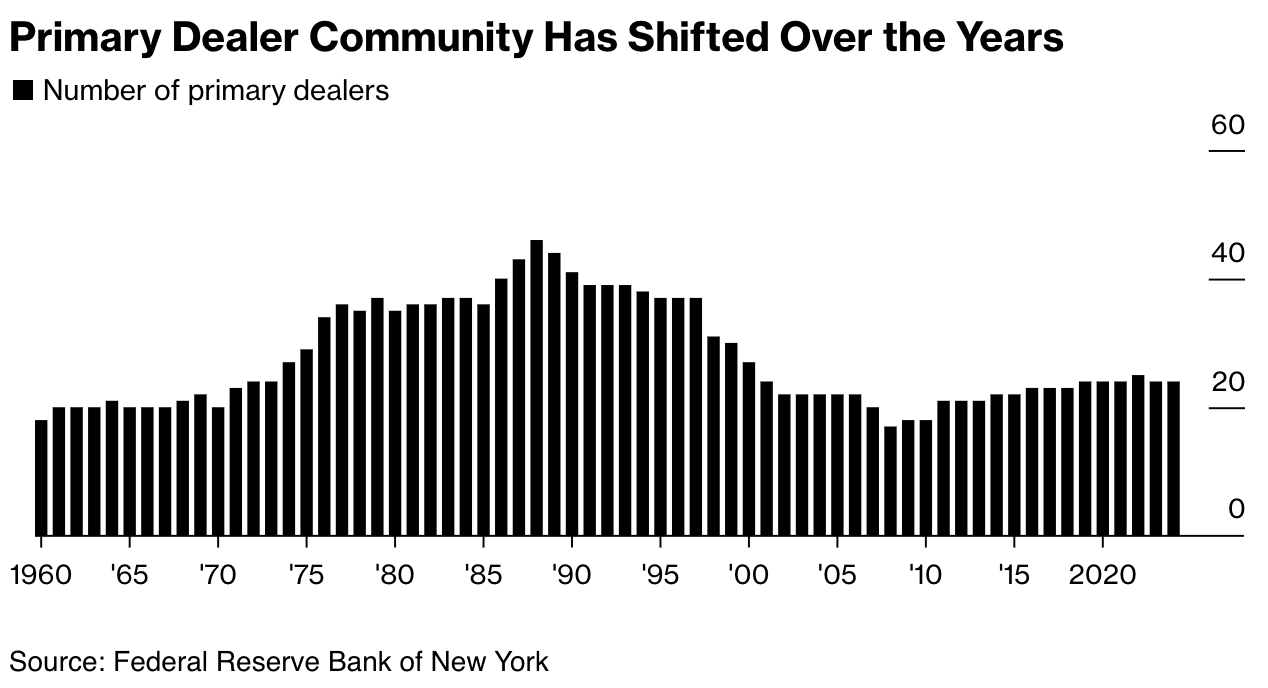

Bloomberg: Treasury’s Elite Bond Dealers Will Struggle to Handle $50 Trillion Debt As US debt balloons, firms that play a vital role in ensuring the biggest bond market works properly warn of the risk of growing pressures.

Ince the club every Wall Street institution wanted to join: the elite network of primary dealers who serve as gatekeepers of the world’s biggest and most influential bond market, US Treasuries. Not so much anymore. Just as America’s debt load is poised to balloon beyond already-record levels, a variety of forces has made membership in this vital cohort less coveted. Ken Griffin’s Citadel Securities in September indicated that it had shelved, for now, its long-touted plans to join the group, with the rise of electronic trading allowing it to earn a spot as a market-making giant despite not being among the Federal Reserve’s select counterparties.

“Issuance has gone up almost threefold in the last 10 years and the anticipation is for it to close to double to $50 trillion outstanding in the next 10 years, whereas dealer balance sheets haven’t grown at that magnitude,” said Casey Spezzano, head of US customer sales and trading at primary markets dealer NatWest Markets and chair of the Treasury Market Practices Group, the government-debt watchdog sponsored by the New York Fed. “You’re trying to put more Treasuries through the same pipes, but those pipes aren’t getting any bigger.”

Some nascent signs of stress have already emerged in the critical market for short-term funding. Here, limits on the ability of bank-affiliated dealers to intervene because of balance-sheet constraints contributed to periodic spikes in key overnight rates — most memorably in 2019, prompting the Fed to intervene, but also as recently as this year in September and now on the cusp of year-end. It isn’t only the primary dealers expressing concern. It’s also many of the investment firms that use dealers to buy and sell bonds as well as several former top policymakers, including onetime New York Fed President Bill Dudley.

They worry about the potential for the type of breakdown in Treasury market functioning that happened at the start of the pandemic, when investors rushed to sell bonds as panic set in. US government debt sold off sharply until the Fed implemented emergency backstop measures to limit the damage. The fear is that a confluence of pressures could strain liquidity and spur dislocations even without an obvious fundamental trigger. “The lender of last resort for a lot of things has become the Federal Reserve,” says Rick Chan, senior portfolio manager at Pacific Investment Management Co. “This does create more volatility.”

Bloomberg: A rebound in global food prices is threatening to add to consumers’ grocery costs this year, just as the agricultural world braces for potential trade disruptions.

A United Nations index tracking raw commodity costs of food ended the year up almost 7%, the first annual gain in three. While it takes time to filter through to supermarkets and the gauge remains well below a 2022 peak, it could put a fresh squeeze on shoppers hit by broader inflationary pressures in recent years.

Although food supplies and prices are often at the mercy of unpredictable weather, this year could bring more uncertainty with Donald Trump’s return to the White House. The incoming president has proposed tariffs across the board on goods imported into the US, and a key question is how any trade wars — especially with China — will impact global flows and prices of food commodities.

“There is a lot of uncertainty and the future direction of policy is one of those uncertainties,” said Monika Tothova, an economist at the UN’s Food and Agriculture Organization. Weather risks, geopolitics and macro-economic policy will also be key influences on commodity prices in 2025, she said.

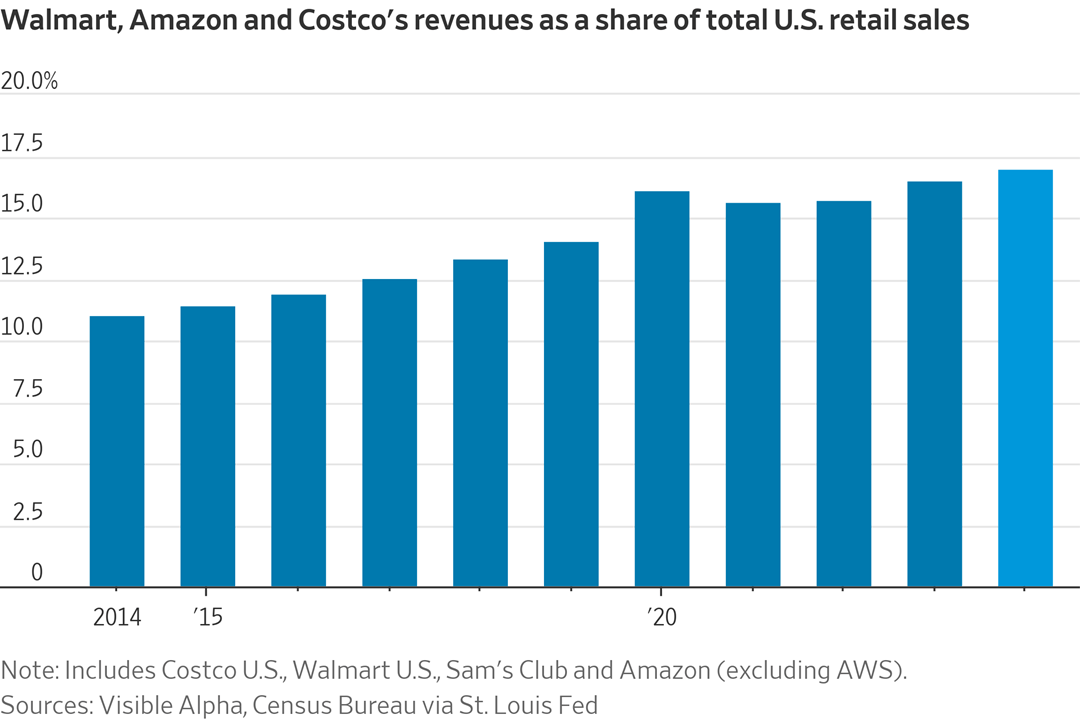

WSJ: Big retailers already dominate Americans’ lives. The three biggest retailers by revenue in the U.S.—Costco, Walmart and Amazon —accounted for about 11% of total retail sales back in 2014, based on their reported figures measured against national retail sales data from the Commerce Department. In their last three reported quarters, the behemoths selling everything from groceries to appliances made up about 17% of retail sales and roughly 57% of retail sales growth over that period.

Supermarkets have been a chronic casualty of the big retailers’ rise. Grocery stores accounted for about two-thirds of food-at-home spending in the U.S. in 2000, but their share shrank to 54% in 2023, according to the U.S. Department of Agriculture. '

Over the same period, warehouse clubs and supercenters such as Costco and Walmart nearly doubled their market share to 23%. Amazon hasn’t grown its share of the grocery market much, but it captures a sizable share of everything else: About three-fourths of U.S. households have Amazon Prime, its paid membership program, according to a 2024 survey from Evercore.

Among some recent casualties are dollar stores, which industry analysts say are losing share to Walmart. The big-box retailer has drawn low-income consumers with a membership program that is half-price for those on government assistance. More than a fifth of Walmart+ members are on food stamps, according to survey results from Evercore. On its December earnings call, Dollar General said it was testing out same-day home delivery from its stores—a move that looks like an effort to play catch-up with Walmart.

Some well-known retail chains have filed for bankruptcy over the past few months, including Big Lots, Container Store and Party City. It is difficult to draw a straight line between their demise and big retailers’ ascendance, but consumers these days can probably find a version of what these specialty retailers used to offer while browsing the aisles—both online and physical—of Walmart, Amazon and the like.

The three big retailers spent an estimated $47 billion on capital expenditures in 2023. That is about four times what Target, Best Buy, and the two largest supermarket chains—Kroger and Albertsons —collectively spent.

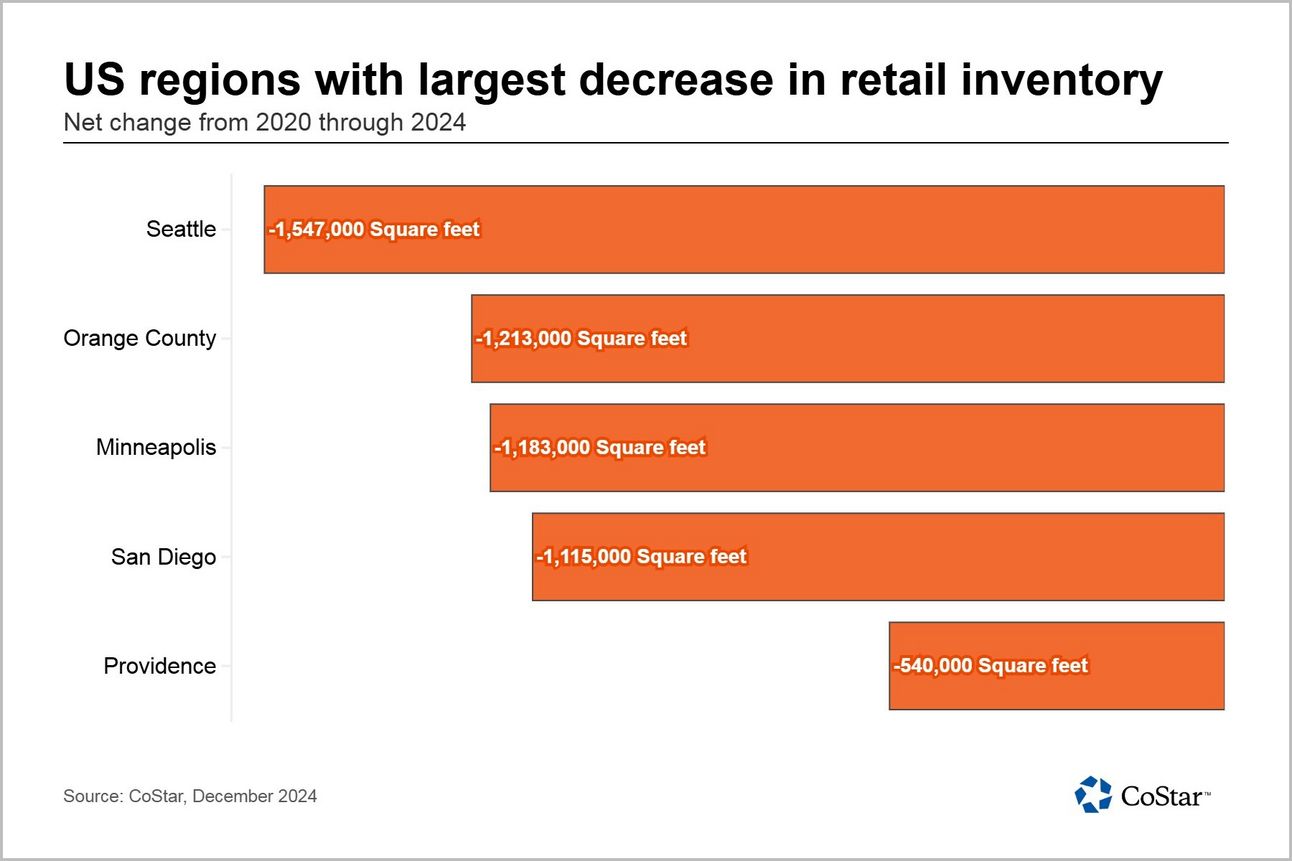

The Puget Sound region has seen the largest drop in retail inventory over the past five years of any U.S. retail market. The amount of space in retail buildings decreased by more than 1.5 million square feet from 2020 through 2024. That shrinkage represents just shy of a 1% decrease in the overall retail inventory in the region over that period.

Despite a drop in occupancy, the area’s shrinking inventory has kept the local retail market tight. The availability rate across the Tri-County area sits at about 3%. That figure fell steadily from a high of 7.9% in 2010 to 2.7% in 2022 before slowly climbing to where it is today. This rate puts Seattle at the top spot, tied with Boston, for the tightest retail availability in the nation.

Seattle was one of nine regions across the nation to see a net decrease over the past five years. The next sharpest drops were in Orange County and Minneapolis, each shedding about 1.2 million square feet of retail inventory since 2020. Rounding out the top five areas with space reductions were San Diego, with a drop of about 1.1 million square feet, and Providence, Rhode Island, dropping by more than 500,000 square feet.

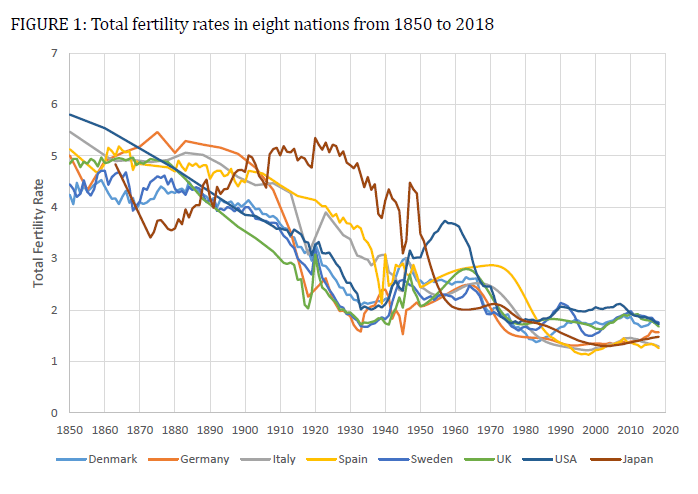

Bloomberg: One of the big questions in demographics is why there’s such a divide in fertility rates globally: East Asia and some European countries have seen steep declines while rates in some Western Europe and Scandinavian countries have been relatively stable. Nobel laureate Claudia Goldin — who was only the third woman ever to get the top prize in economics — adds one answer: economy clashing with tradition.

Countries where fertility rates have plunged in recent decades (South Korea and Japan among them) also experienced rapid economic growth after the 1950s compared to peers. That gave women more freedom very quickly, but society — and men— haven’t caught up to changing conditions. Goldin’s quick to note it’s not just about gross domestic product expansion, but also the transformation to a society with “developed markets, thicker communication networks, and denser settlements.”

The Promote: In Sept., WSJ reported on a move by Trump insiders to figure out how to end govt. control of Fannie & Freddie, which together owned/guaranteed 40% of the $2.2T multifamily mortgage market as of fall ‘23. Any offering of the govt.’s Fannie & Freddie stakes could be valued at 100s of billions of dollars, so you’d need the world’s biggest investors to get involved.

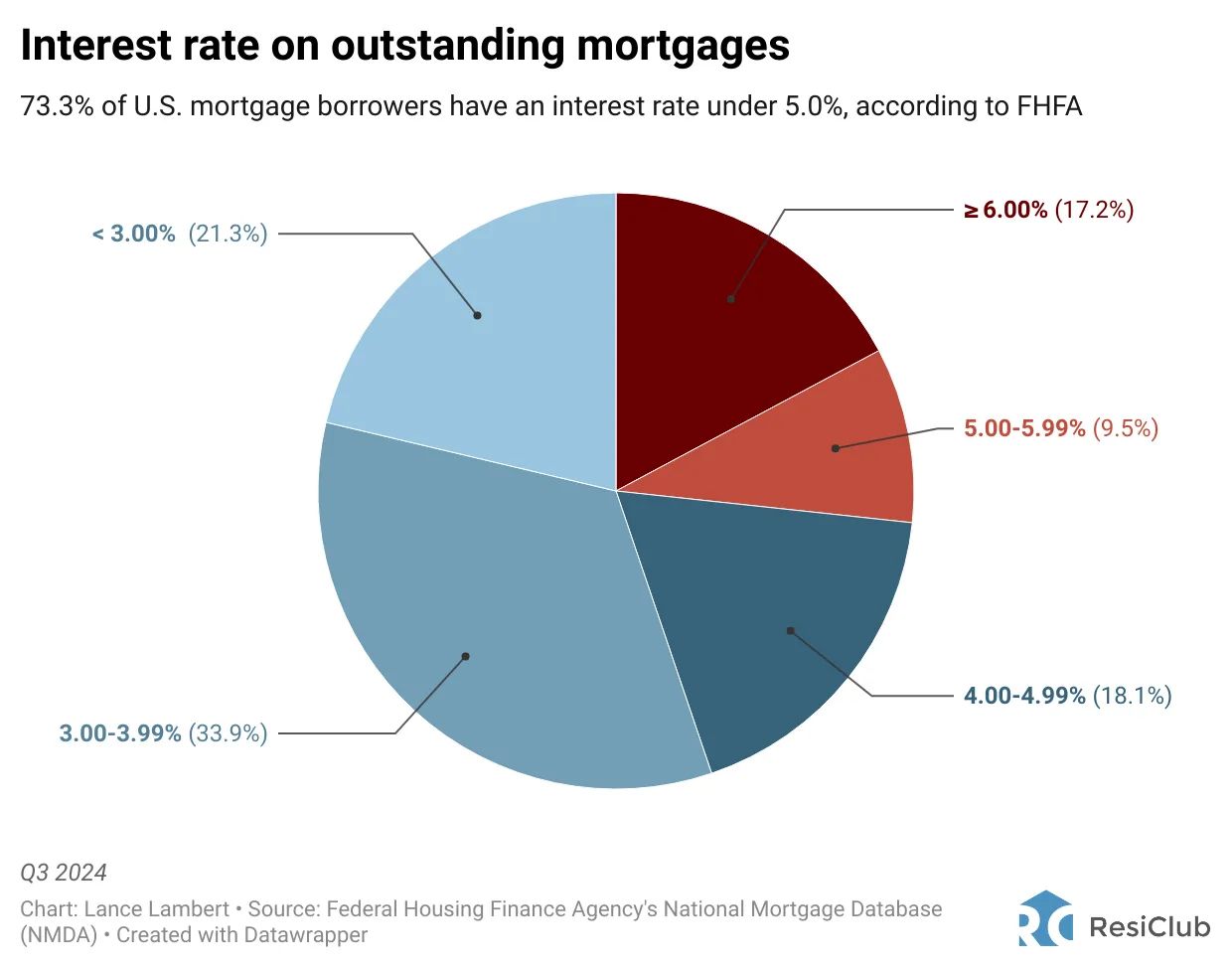

Before borrowing costs surged, a remarkable 85.5% of U.S. mortgage borrowers had interest rates below 5.0% in Q1 2022. However, as mortgage rates remain "higher for longer," that share continues to shrink. Most new borrowers are now predominantly taking out loans with rates with a 6-handle or 7-handle. Indeed, according to newly released third-quarter data from the FHFA, 73.3% of U.S. mortgage borrowers currently have interest rates below 5.0%. This marks a 12.2 percentage-point decline from the historic Q1 2022 level (85.5%).

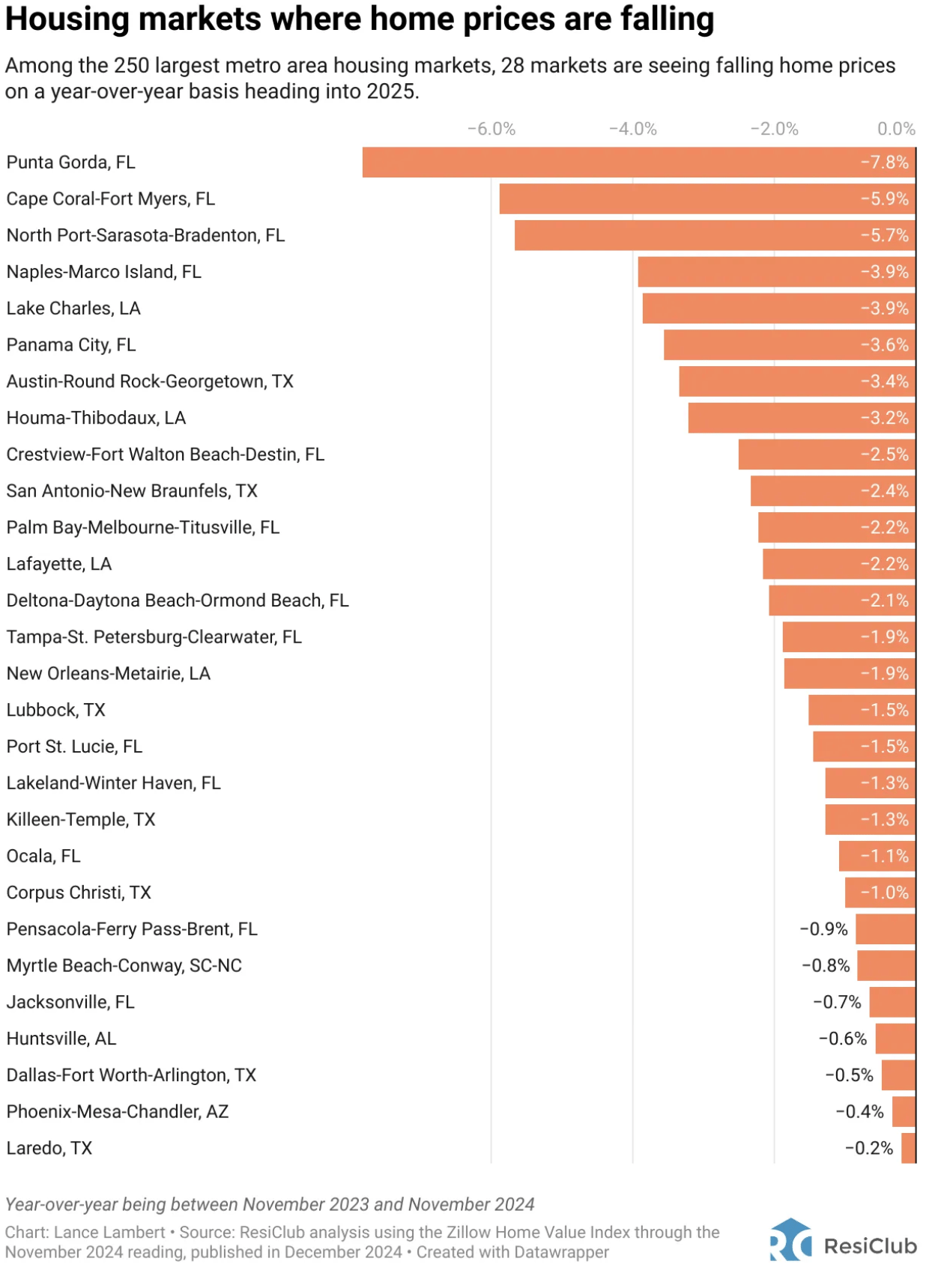

While home prices are still rising in tight inventory markets in places like most of the Northeast, Midwest, and Southern California, some regional housing markets in states, such as Texas, Florida, and Louisiana, where inventory has risen above pre-pandemic 2019 levels, are experiencing mild home price corrections. That includes major metros like Austin, TX (-3.4%); San Antonio, TX (-2.4%); Tampa, FL (-1.9%); New Orleans, LA (-1.9%); Jacksonville, FL (-0.7%); Dallas, TX (-0.5%); and Phoenix, AZ (-0.4%).

Developers kicked off 2025 by announcing the priciest commercial property deal on record in Miami's only neighborhood that allows the construction of supertall towers, the latest sign of a development surge across the city's financial district.

Oak Row Equities, a private equity and real estate development firm based in New York and Miami, and Mariposa Real Estate said they put a 4.25-acre site in Miami under contract for $520 million.

The property, 1001 and 1111 Brickell Bay Drive, are owned by Denver-based Aimco. The deal is expected to close by the fourth quarter of 2025. The location is home to a 32-story office building, originally constructed in 1985, and a 357-unit, 31-story apartment complex built in 1998.

The assemblage is the largest waterfront parcel of its kind, located along Biscayne Bay with 485 feet of waterfront access. The property is zoned for over 3 million square feet of development and is in the sole neighborhood where supertall towers, or buildings over 984 feet, can be built.

The sale breaks the neighborhood record for a land deal. A $363 million deal previously held the record when, in 2022, Ken Griffin, the CEO of hedge fund Citadel, acquired a site at 1201 Brickell Bay Drive, just down the street, for a future supertall headquarters tower.

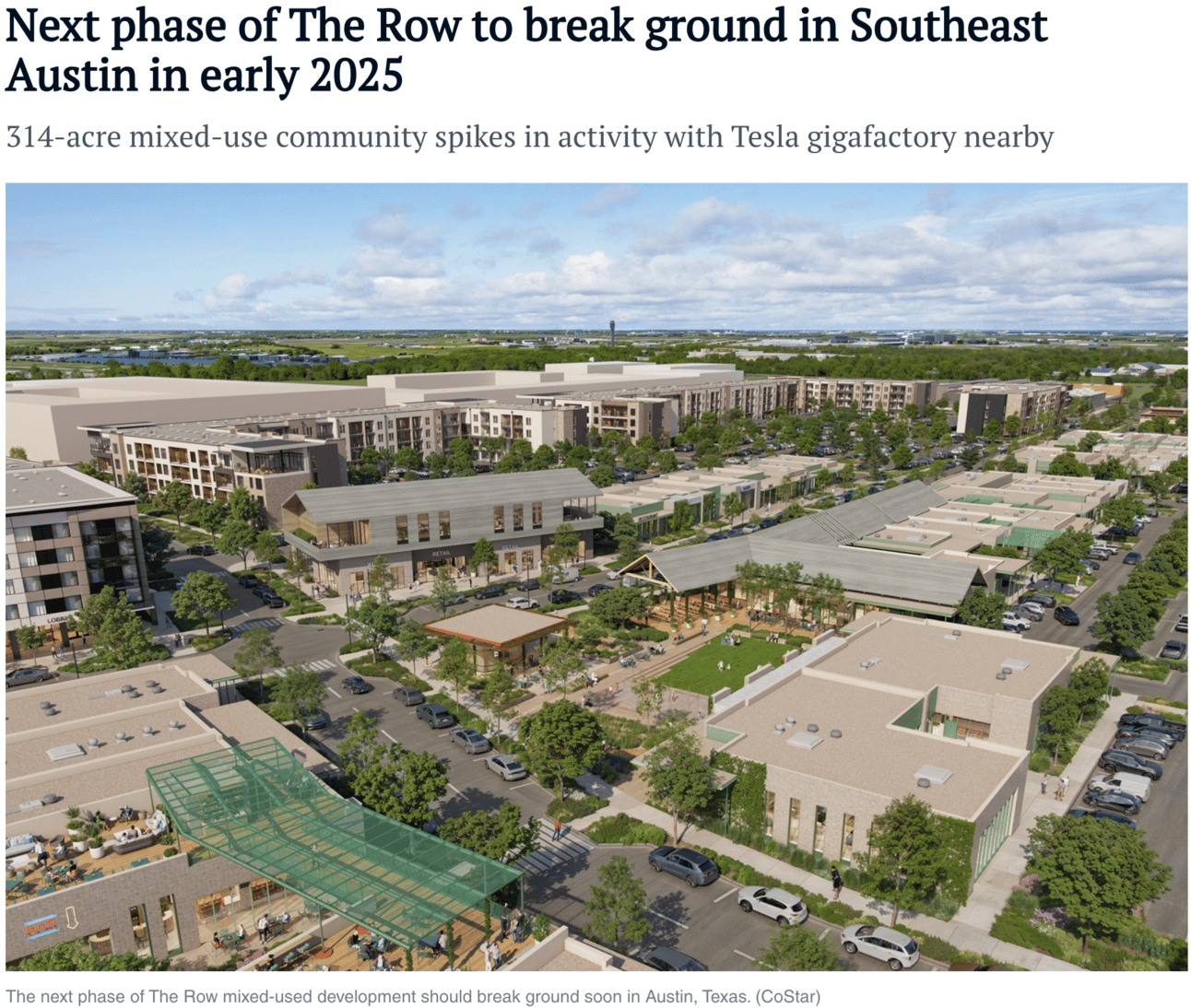

Presidium is soon to break ground on the next phase of its Austin, Texas, mixed-use development, The Row.

This next portion is a 6,250-square-foot free-standing restaurant site and an additional 22,000 square feet of retail space. The project is supposed to bring much-needed retail, restaurants and entertainment options to this area of Austin.

Phase three, expected to break ground shortly after this one, is to include 100,000 square feet of retail, an AC Hotel by Marriott and a second 300-plus-unit multifamily project, according to marketing materials. The project was previously called Velocity.